Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

Trading Depot Overview - My experiences from the last trading week 04.08.2024

Depot review

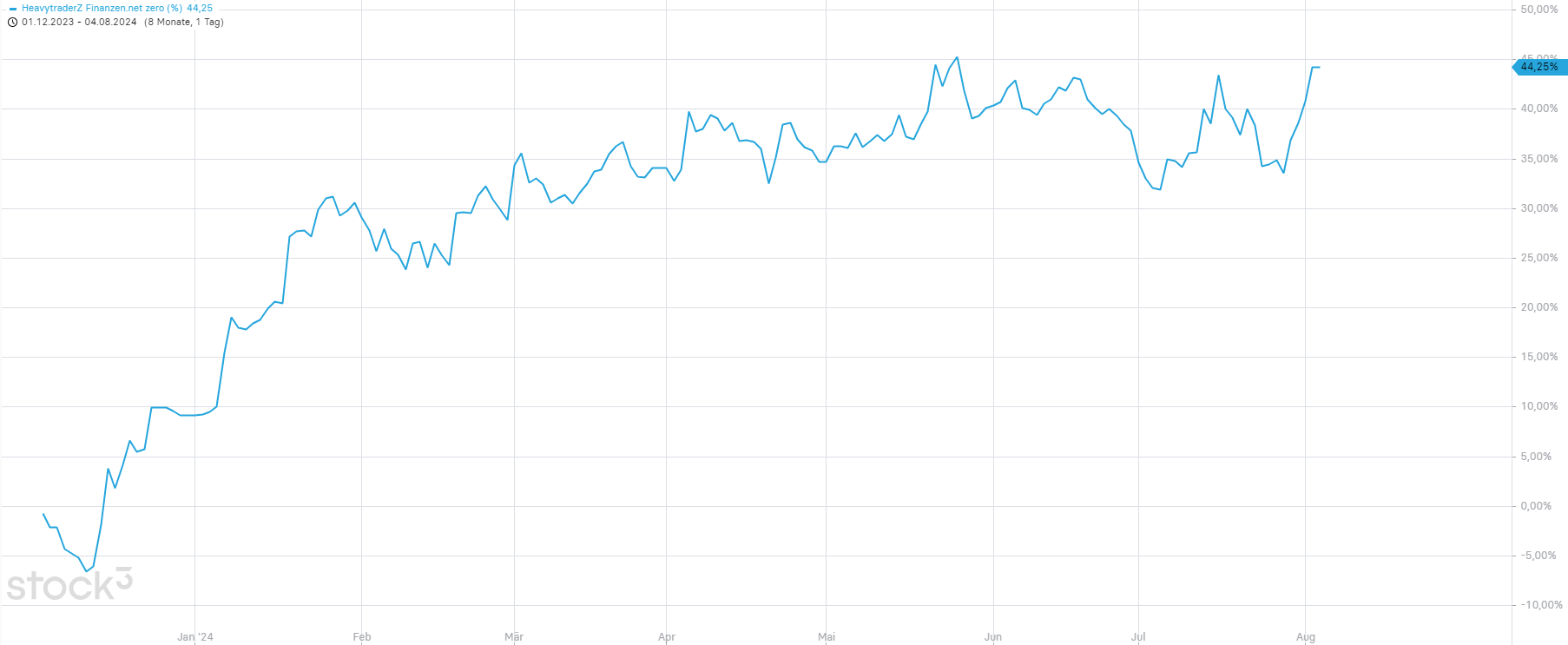

What a week, what an incredibly volatile month. I'm so glad that it's over and that my record series is continuing. For the 9th month in a row since I became part of HeavyTraderZ, I've been able to increase my portfolio performance every month - and by almost 10% compared to the previous week. Including all book profits and losses, the current portfolio performance is 44.25%. That's an increase of 8.39% compared to the previous week.

Orders executed

As expected, it was volatile. The Brent position was closed at a loss, while the long position on the Nasdaq100 was stopped out at the opening price. I was also able to close two DAX positions and a long gold position extremely profitably. In addition, a short position on gold was closed at a loss, as were the long positions on Ingersoll-Rand, Henkel and Hermes. Finally, I was able to successfully trade a Nasdaq100 short position last week. Quite hectic by my standards, but I had to adapt to the volatility.

Planned procedure

I expect big movements in the next few weeks, but not highly volatile movements that go up one day and down the next. Overall, I now expect clearer chart structures, which will also help me to implement profitable trades. First of all, I expect recovery movements to the upside in the coming week, which could potentially have the potential to reach several hundred points. In the short term, I can certainly imagine implementing these. In the medium term over the next few weeks, and that will mainly be my trading activities, I will be shorting the indices and various stocks again.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

AI stock screening of the week on April 19, 2024

AI stock screening of the week on April 19, 2024

AI STOCK SCREENING OF THE WEEK ON 04/26/2024

AI STOCK SCREENING OF THE WEEK ON 04/26/2024

AI stock screening of the week on 03.05.2024

AI stock screening of the week on 03.05.2024

AI STOCK SCREENING OF THE WEEK ON 10.05.2024

AI STOCK SCREENING OF THE WEEK ON 10.05.2024