Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

Trading Depot Overview - My experiences from the last trading week 21.07.2024

Depot Review

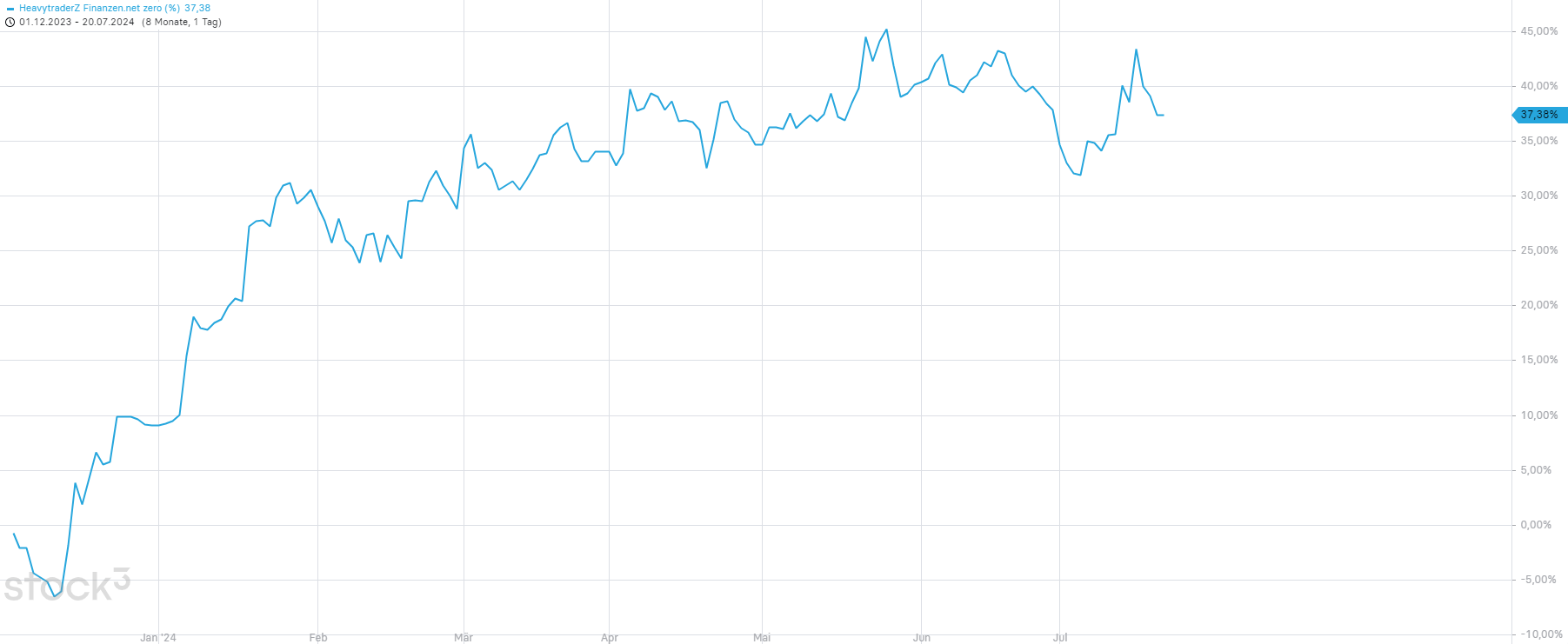

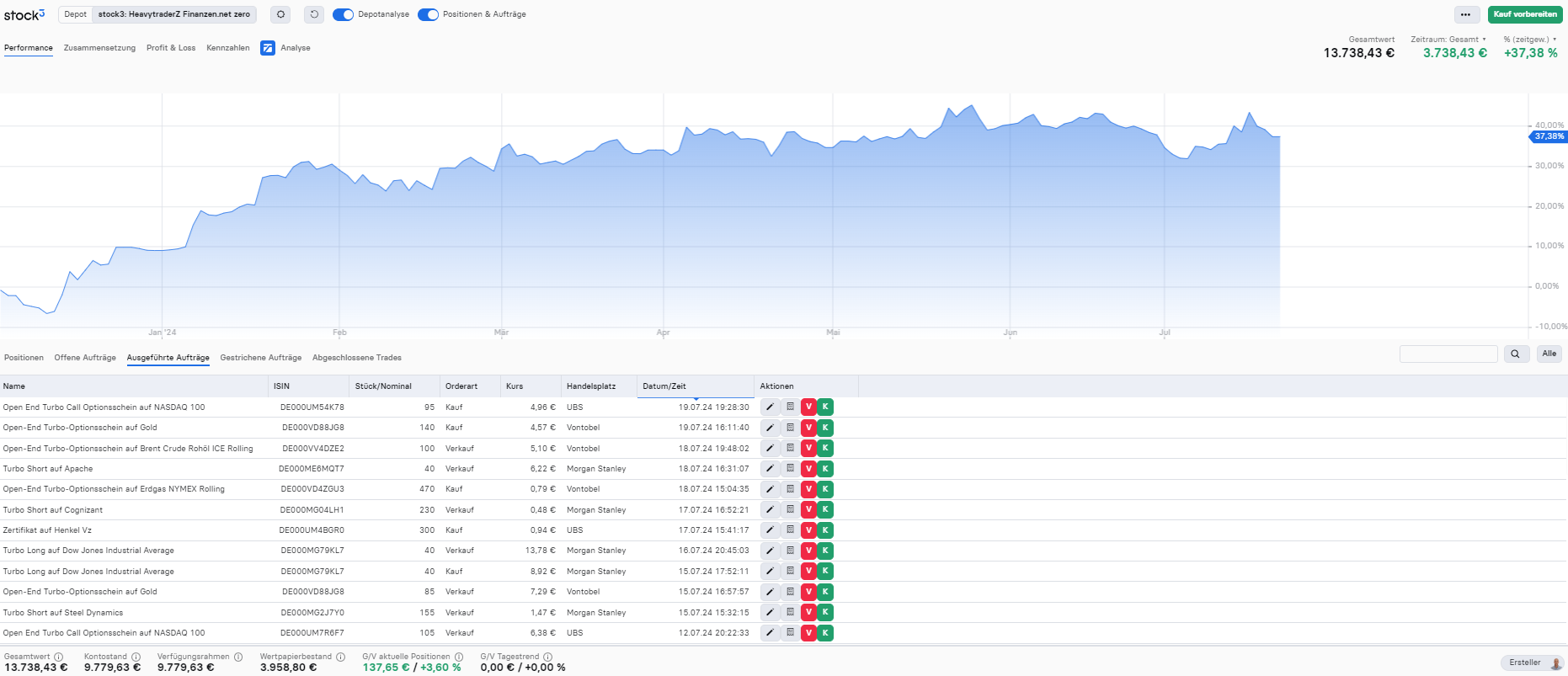

As expected, volatility remained high. In addition to a few swing trades that were designed to last several days, I recently included shorter-term trades lasting a few days. The downward trend of the financial markets only played into my hands to a limited extent. In terms of portfolio performance including all book profits and losses, portfolio performance fell from 40.07 percent to 37.38 percent. This corresponds to a decline of 2.69 percent.

Nevertheless, since the portfolio was launched on December 1, 2023, an average monthly performance of around 4.6 percent has been achieved to date, without there being a single month with a negative portfolio performance.

Trades executed

The short positions on Cognizant, Steel Dynamics and APA Corp as well as the Brent short position were closed at a loss. The short-term long positions on the Dow Jones Index after the breakout to a new all-time high and the long order on gold were closed very profitably. A long position on Henry Hub Natural Gas was opened, however, and the holding period is planned for several weeks. Other shorter-term long trades were opened on Henkel, due to the very strong preliminary quarterly figures, the Nasdaq 100 Index and on gold.

Planned procedure

After the recent strong declines, I expect further weakness in the financial markets in the medium term in connection with the summer seasonality. I will use recoveries, especially in the indices, to enter short positions. In addition, I plan to select weak stocks and focus more on short positions. In my opinion, it is still important to proceed very selectively. .

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

AI stock screening of the week on April 19, 2024

AI stock screening of the week on April 19, 2024

AI STOCK SCREENING OF THE WEEK ON 04/26/2024

AI STOCK SCREENING OF THE WEEK ON 04/26/2024

AI stock screening of the week on 03.05.2024

AI stock screening of the week on 03.05.2024

AI STOCK SCREENING OF THE WEEK ON 10.05.2024

AI STOCK SCREENING OF THE WEEK ON 10.05.2024