Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

AMD shares: AI chips boost the company -- Current buying opportunity

Company description

Advanced Micro Devices designs and manufactures microprocessors for the computer and consumer electronics industries. The company makes the majority of its revenue in the computer market from CPUs and GPUs. AMD acquired graphics processor and chipset maker ATI in 2006 to improve its position in the PC food chain. The company spun off its manufacturing operations in 2009 and formed a foundry joint venture, GlobalFoundries. In 2020, the company agreed to acquire FPGA market leader Xilinx.

AMD has high hopes for the AI chip "MI300" for data centers, with which it hopes to steal market share from global market leader Nvidia. A few weeks ago, AMD also introduced a number of AI chips that are to be installed in PCs and laptops. The industry is booming and many do not see AMD as competition to Nvidia - but AMD should not be underestimated.

Fundamentals

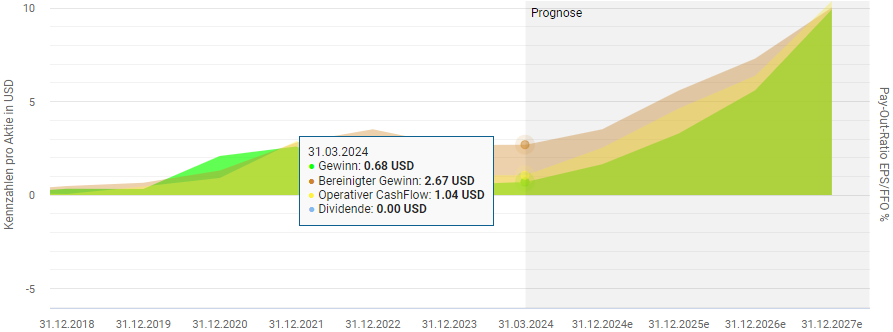

Since the acquisition of Xilinx in 2020, the company has been able to significantly increase its profits and operating cash flow. According to analyst estimates, AMD is expected to increase earnings per share more than fifteenfold within three years! There is no question that there is a lot of potential in the field of artificial intelligence that is sure to unfold in the next few years.

Chart technical outlook

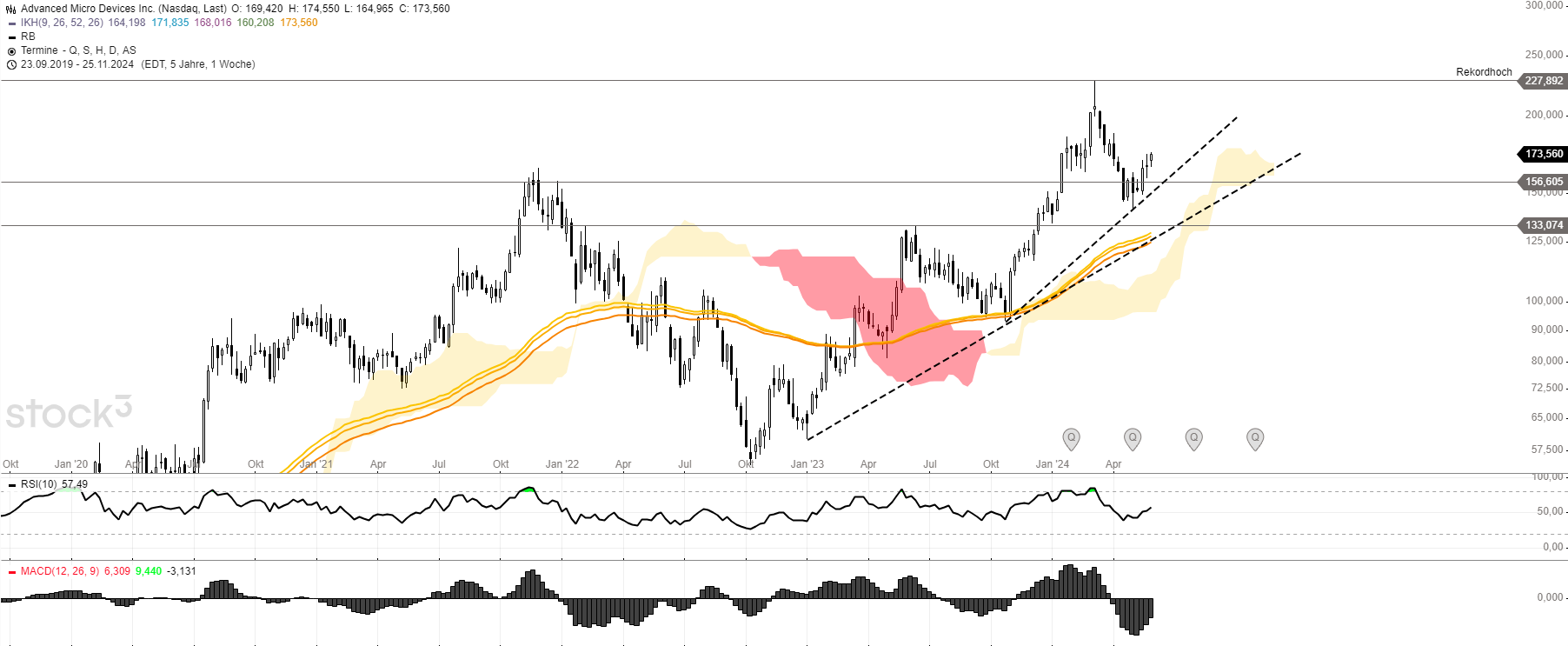

The chart can also convince trend-following investors and traders. The share has been correcting since the most recent record high of USD 227.89. Meanwhile, the securities are returning to an ideal retracement area. The price zone of around USD 145 seems favorable to recoup the potential AI giant.

In the weekly chart, market participants are already signaling initial buying interest. If this prevails, as currently appears to be the case, reaching the current all-time high should only be a matter of time. However, to be on the safe side, I would factor in another correction opportunity into the aforementioned anti-cyclical buying area between 133 and 156 USD over the volatile summer period, which is considered a general period of weakness on the financial markets.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

Oil is picking up again - buying opportunity for oil companies

Oil is picking up again - buying opportunity for oil companies