Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

Puma - Ideal correction invites you to buy

Company description

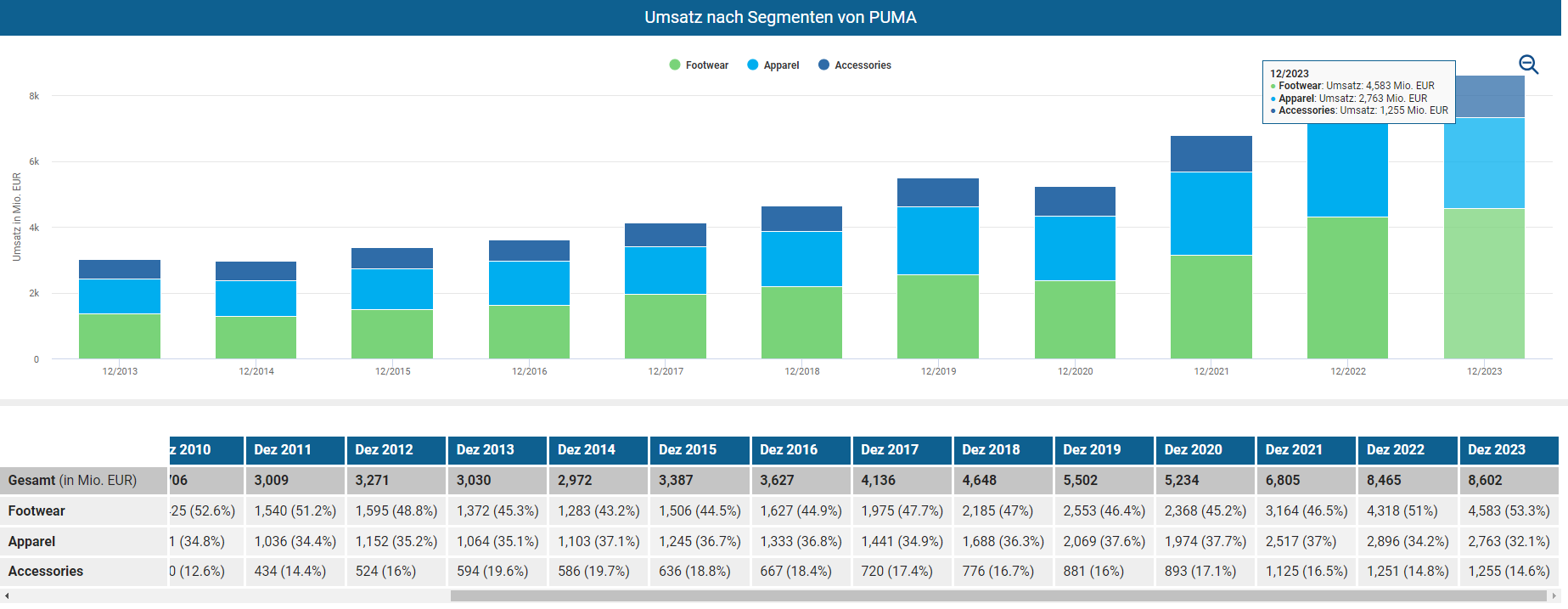

Puma designs and sells footwear, apparel and accessories under its own name, and golf clubs and golf accessories under the Cobra Golf name. The largest category is footwear (53% of sales in 2023), followed by apparel (32%) and accessories (15%). Puma also licenses its name for perfumes, eyewear and watches. Most (75% in 2023) sales are made through wholesale partners, with the rest through around 1,000 owned retail and outlet stores and online channels. The company's products are sold in Europe, the Middle East and Africa (40% of sales in 2023), the Americas (39%) and Asia-Pacific (21%).

Fundamentals

The most recent quarterly figures reported at the beginning of May impressed market participants. Although profits and sales were slightly down on the previous year, what was far more important was that the company's figures exceeded analysts' estimates, with a margin increase from 46.5 to 47.5 percent.

This year, the UEFA Euro 2024 football tournament is coming up again. Alongside the Paralympics, this is an extremely important sporting event to bring Puma's products, which generate the most sales, especially in the "footware" segment, back into focus.

Chart technical outlook

From a chart perspective, I see all the conditions for a medium-term trend reversal being met. After a symmetrical triangle had formed, the last downward movement also created a turnaround.

Over the next few days, I expect another attempt to reach the EUR 53.20 mark. The ideal retracement zone of EUR 47.00 has currently been reached. This is where various support aspects such as the 61.8 retracement, 4H candle reversal, the uptrend line, the IHK cloud and the rainbow indicator converge.

In the best case scenario, buyers will take action again and allow the share price to rise above the temporary downward trend line and start a new buying impulse. I intend to position myself long here.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity

Oil is picking up again - buying opportunity for oil companies

Oil is picking up again - buying opportunity for oil companies