Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

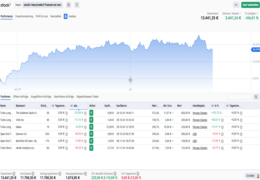

Wöchentlich möchte ich euch gerne an einem Update meiner Handelsstrategie teilhaben lassen, die ich im Bereich des kurzfristigen Swingtradings mit Knock-Out-Produkten umsetze. Aufgrund der Hebelmöglichkeit der relativ überschaubaren Haltedauer der Trades, ist es enorm wichtig eng am Marktgeschehen und bestens informiert zu sein, gerade wenn man Derivate handelt.