Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

Amazon at record high - a short-term buy -- medium-term toppy?

Company description

An important segment of Amazon is online commerce, where Amazon serves as a platform for buying and selling a wide range of products. In addition to selling goods under its own name, Amazon also offers other retailers the opportunity to sell their products through the Amazon platform.

Another important business area is the area of cloud computing services under the name Amazon Web Services (AWS), which offers a variety of services such as computing power, database storage and content delivery networks. AWS is considered a leading provider in the cloud sector and serves an extensive customer base that includes start-ups as well as large companies and public institutions.

Amazon is also active in the streaming sector with Amazon Prime Video and acts as a producer and provider of film and series content. Amazon also develops and produces its own consumer electronics, known for the Kindle e-book reader, the Alexa voice assistant and the Echo series smart speakers. This sector is referred to as consumer electronics.

In addition, Amazon operates physical retail stores such as bookstores and the grocery retailer Whole Foods Market. The company is also expanding into the digital payment services space, offering an e-commerce payment solution with Amazon Pay.

Short-term chart outlook

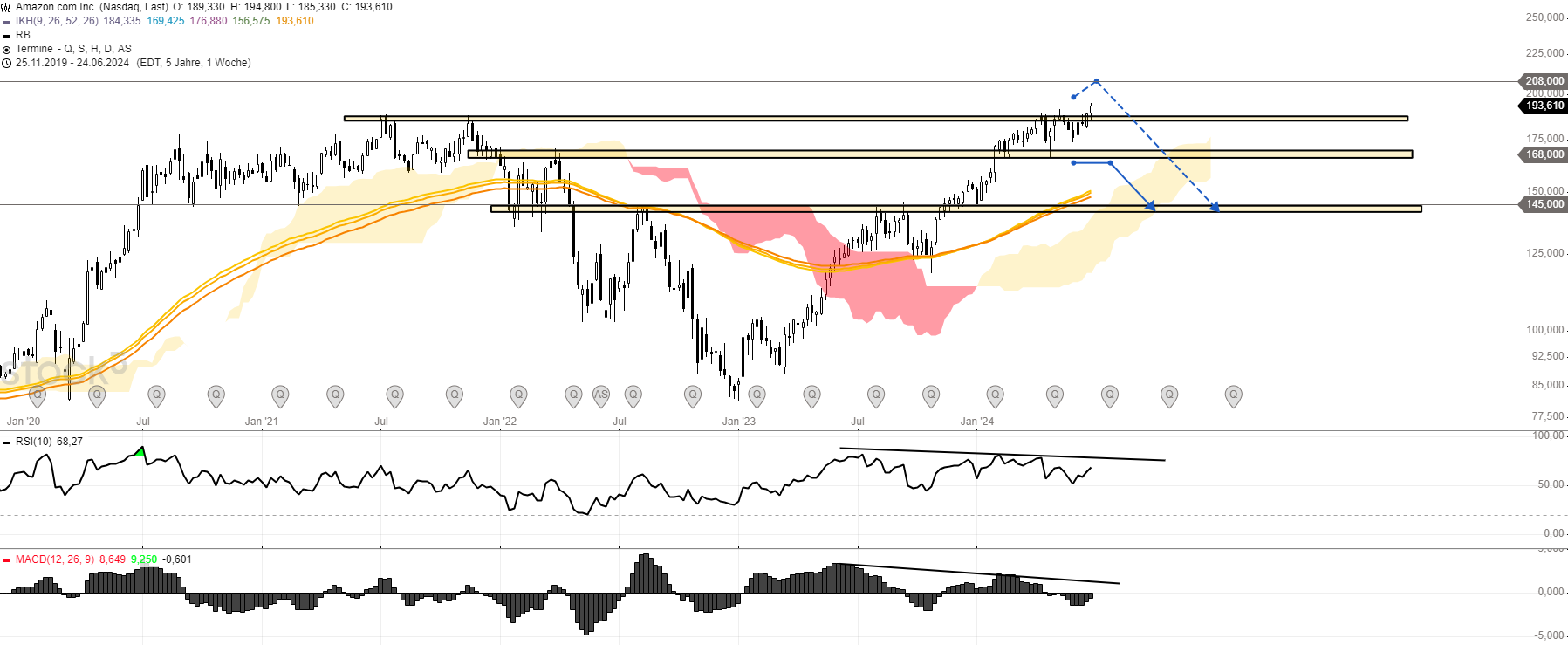

The short-term chart technical outlook also encourages you to buy Amazon shares. Yesterday, bullish market participants managed to break out dynamically to a new record high! The share price also overcomes the intermediate hurdle of 191.50 USD. This represents a new buy signal. The upper price mark of 208 USD would be the technical target zone. The potential is certainly profitable to trade with around 7.5% on the upside.

Medium-term chart outlook

However, the price level of USD 208 is also an important medium-term target for Amazon. It is quite conceivable that this price range could lead to a more significant correction. In particular, indicators such as RSI and MACD are already showing massive divergences. They do not confirm Amazon's new-found strength in the medium term. If the price zone of around USD 208 is actually used by the sellers, we are talking about a correction potential of almost 30%. To generate initial signs of this, a first bearish step would be to break through the support level of USD 168. This should inevitably lead to the first important correction level of USD 145.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity