Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

CAC 40 - French Index -- Baguettes soon on offer?

CAC 40 Index

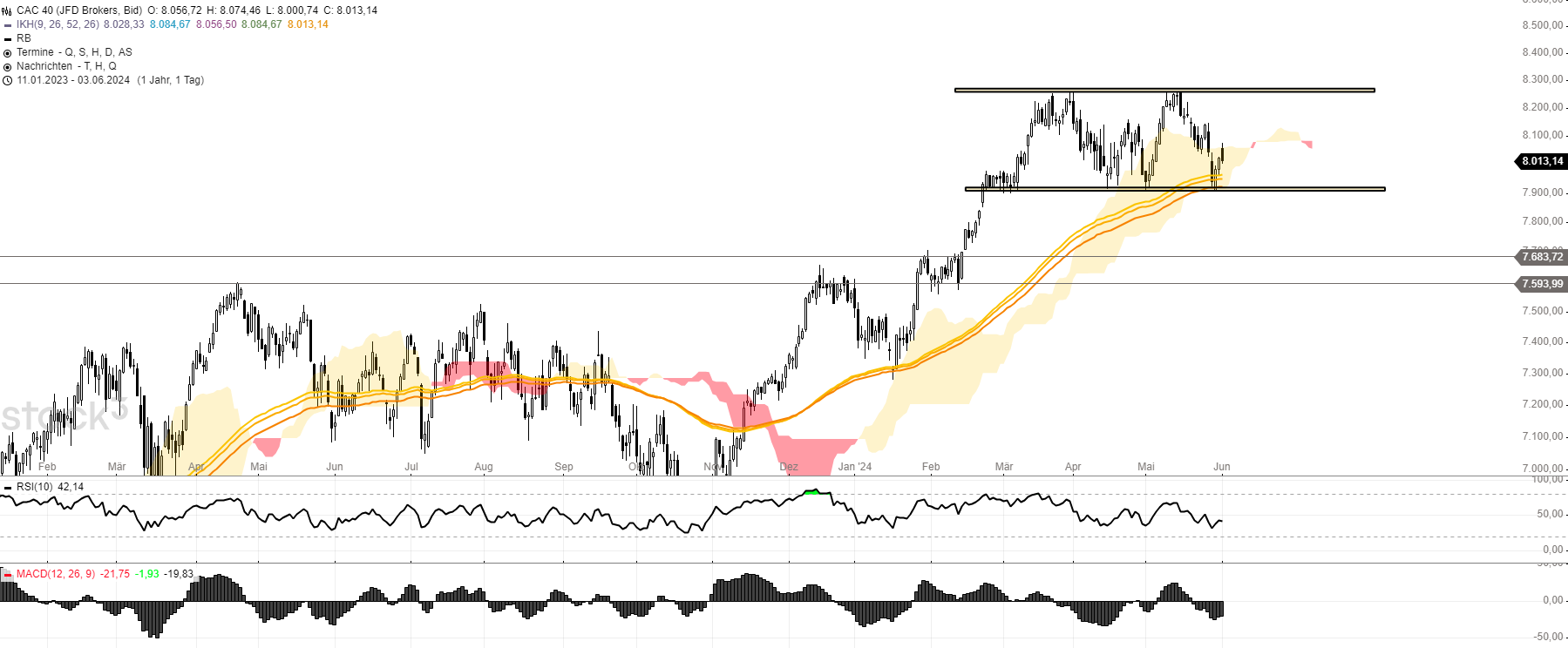

CAC 40 is a French benchmark index of the 40 leading French stock companies traded on the Paris Stock Exchange. CAC stands for Cotation Assistée en Continu. Perhaps an index that is not very popular or traded - but as a trader I focus on the simple opportunities. That could be the case in the CAC 40 at the moment. Due to the expected weak seasonality over the summer months, this index is also at risk and could move into a more significant correction.

Chart technical outlook

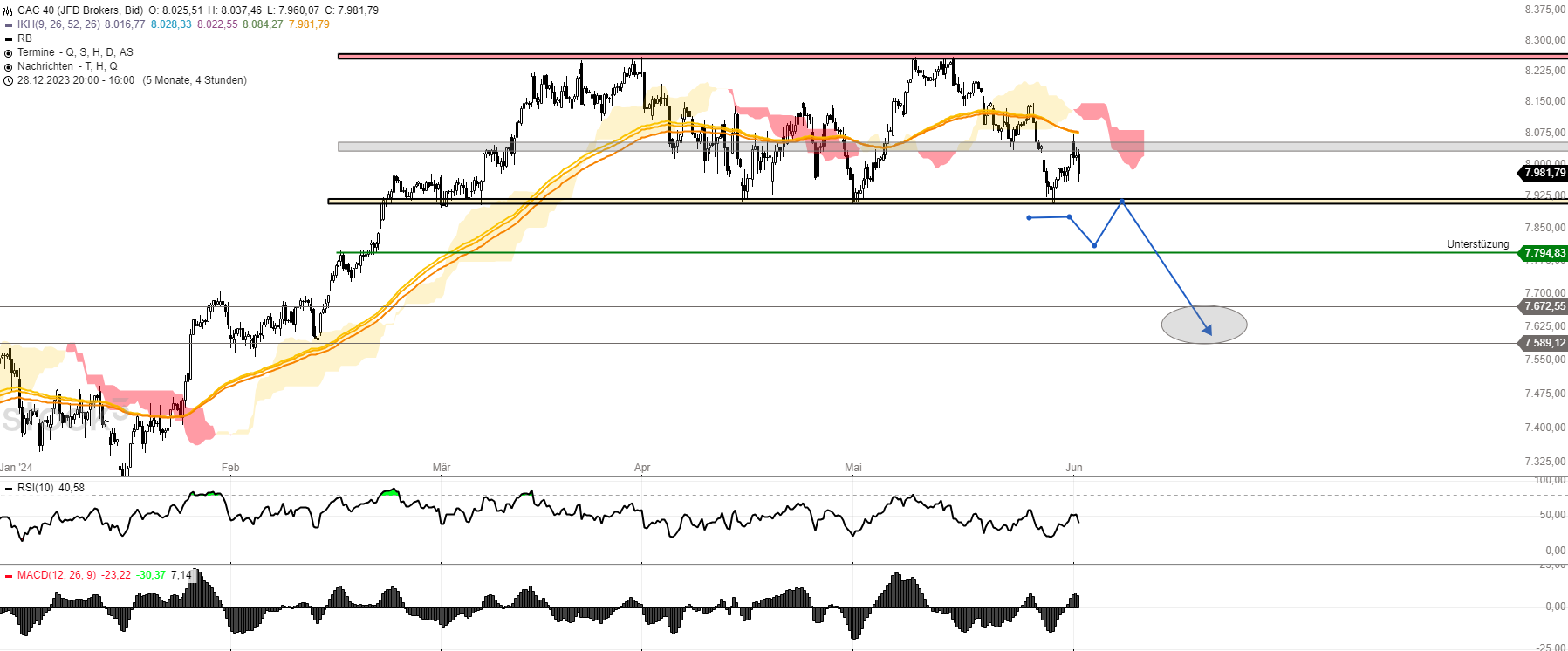

The index has recently been trading in a range between 8270 and 7920 points. If the massive support at the lower edge of the range falls, I expect a correction to the range of 7680 to 7590 points.

The liquidity zone of 8050 points has already had an effect today. The sellers are back. If the index falls below 7920 points in the next few days, a short position is certainly a good option. I expect an initial stabilization at the former record high of 7670 points. The CRV would be attractive for such a short position. I am therefore watching the index very closely.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity