Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

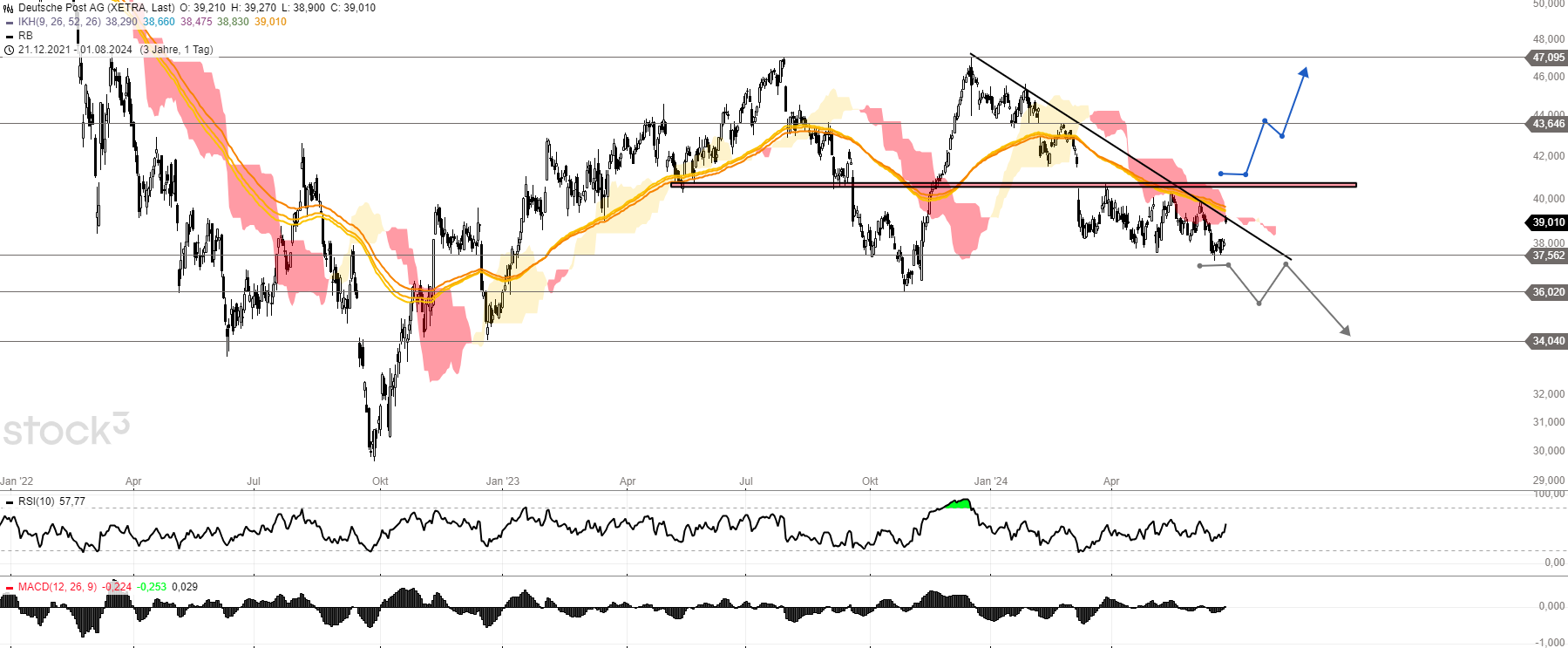

DHL Group - Fedex figures boost -- Is the share price now gaining momentum?

Company description

The DHL Group operates in the segments Post, eCommerce, Logistics and Express Delivery. In the Post and eCommerce segment, DHL focuses on letter and parcel delivery as well as online shopping services. These services are aimed at both private and business customers with the aim of simplifying the sending and receiving of shipments.

In the Logistics division, DHL offers comprehensive logistics solutions, including warehousing, transportation, supply chain management and other related services. These services are tailored to the needs of companies in a wide range of industries, including automotive, healthcare, technology and consumer goods.

The Express Delivery segment deals with the fast and reliable shipping of shipments. DHL Express is known for its time-critical international shipping services, where customers can expect deliveries for specific dates or guaranteed next day.

Latest news

FEDEX’s reported quarterly figures, which of course have implications for the entire sector, were as follows:

Fedex beat analysts' estimates of $5.34 with earnings per share of $5.41 in the fourth quarter. Revenue of $22.1 billion exceeded expectations of $22.05 billion.

The share price rose by over 14% after hours, while DHL Group rose by 2.5%. We are still in difficult economic waters. DHL Group will present its company figures on August 1, 2024. I do not expect any major increases in sales and profits here either. The outlook and the Group's cost savings will be much more important.

Chart technical outlook

Chart-wise, DHL is currently in the middle of a trendless trading range of EUR 37.50 and EUR 40.50. With today's gap up, the share has managed to jump to the striking downward trend line. However, it will be more important to be able to maintain this new-found strength and break out above EUR 40.50. This would then most likely lead to further upward movements above EUR 43.60 and up to EUR 47.

However, if there is no significant trend change, especially with the company's own figures, there is a risk that the DHL Group could fall below EUR 36 or even as low as EUR 34.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity