Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

Dow Jones Index - Will the double top come over the summer?

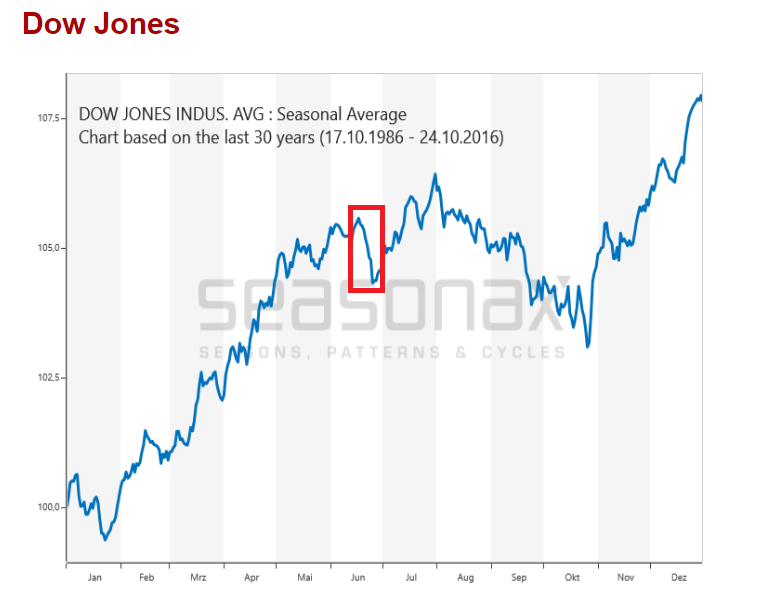

Seasonality

The Dow Jones Index is made up of the 30 largest companies in the USA. It is surprising what we could possibly expect from it. A significant correction could therefore be on the horizon. Above all, the weak seasonality is likely to increasingly come into focus for market participants.

It is clear that we are facing a severe seasonal correction, starting in the second half of June.

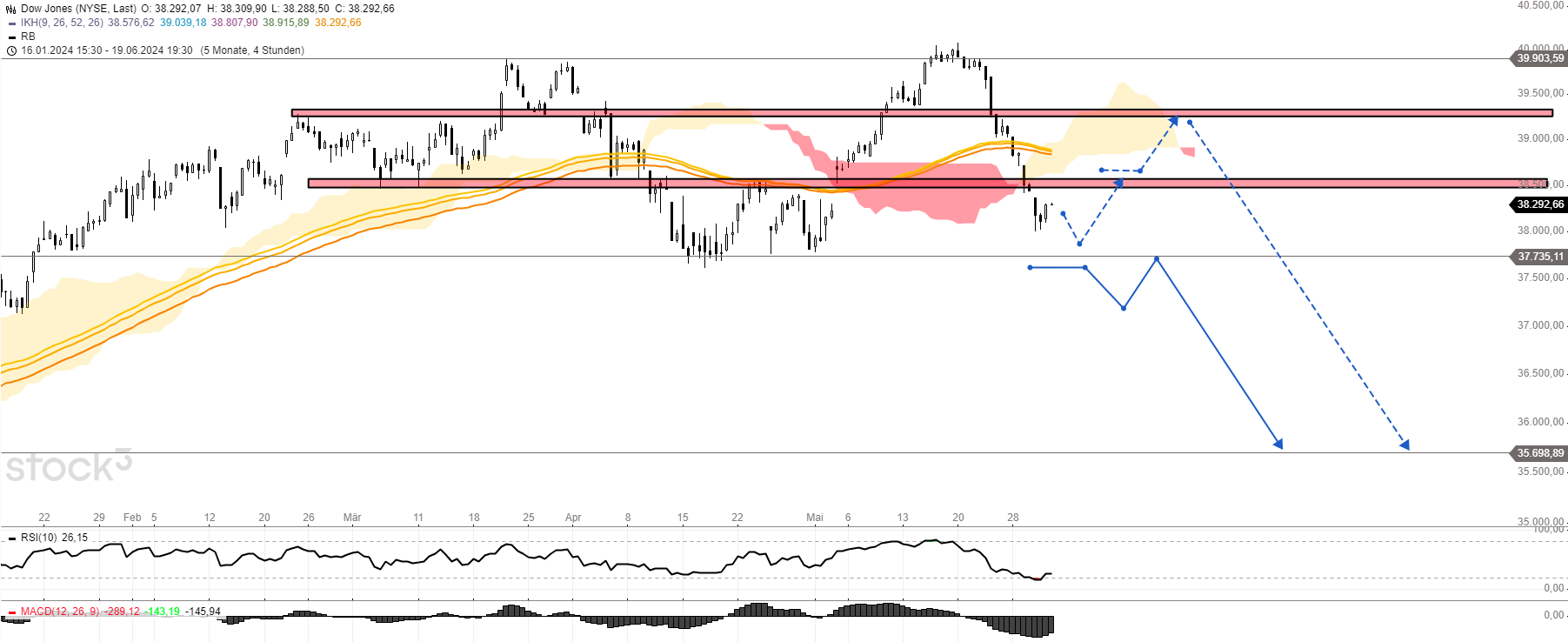

Medium-term chart outlook

Meanwhile, the charts are already looking very shaky. After the recent record high of 40,000 points, a potential double top is now emerging. It is important for a double top that the second rise was higher than the original high. This was the case with the Dow Jones. Accordingly, the neckline is classified at just under 37,735 points. If this important mark falls, trouble looms. Over the next few weeks and months until autumn, a score of 35,700 points in the Dow Jones could become realistic.

Short-term chart outlook

In the short term, however, I expect prices to recover. The current weakness could be corrected first. The points of 38,500 and 39,300 points are suitable for recovery targets. I will look for short opportunities here. If the procyclical sell signal comes through immediately, I also plan to position myself accordingly.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity