Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

Goldman Sachs Group - Consolidation before new record high offers opportunities

Company description

Goldman Sachs is a global financial services company that operates in various business areas. Its core business includes investment banking, global markets, asset management and consumer & wealth management. In the investment banking sector, the company offers services such as corporate financing, advice on mergers and acquisitions and the issuance of securities.

The Global Markets segment is engaged in buying and selling financial products, providing liquidity in the capital markets and offering financing and advisory services to institutional clients. Asset Management is focused on managing assets for a wide range of clients, including pension funds, sovereign wealth funds and private individuals. Consumer & Wealth Management is aimed at private clients and includes services such as asset management, investment advisory and banking services.

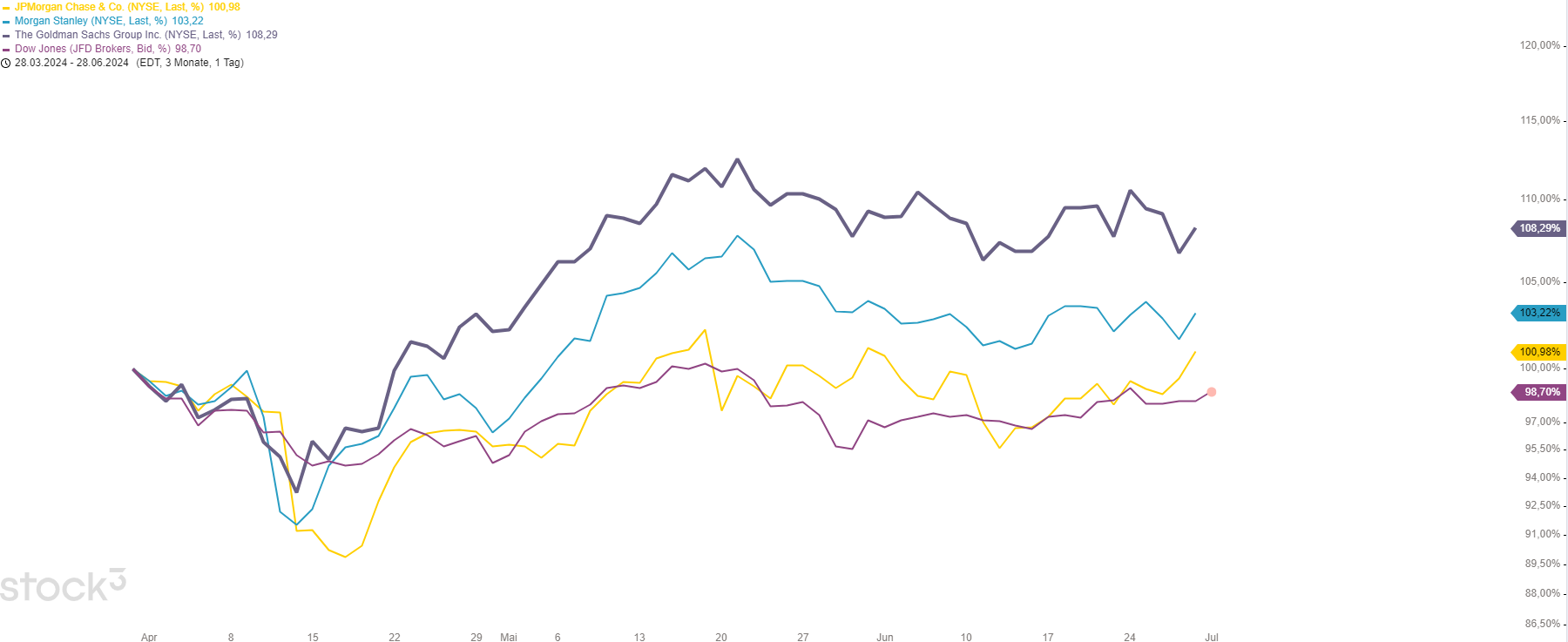

Performance comparison

The financial service providers alongside JP Morgan, Morgan Stanley and Goldman Sachs are currently still in demand. Here is an overview of the performance comparison:

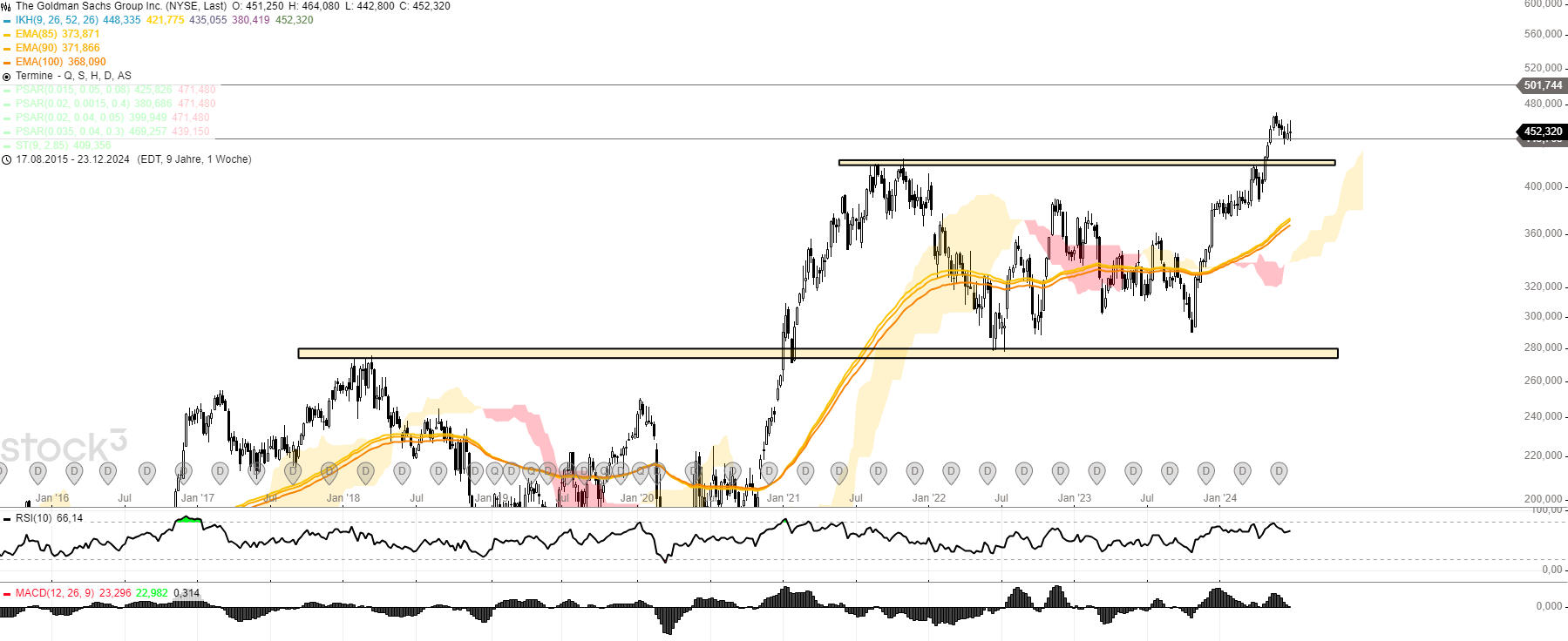

Chart technical outlook

The outperformance compared to the competition and the Dow Jones is extremely strong. This is one of the reasons why Goldman Sachs shares are interesting on the long side. The medium-term picture is clearly bullish. The share recently opened new record highs and broke above the last all-time high of USD 423.

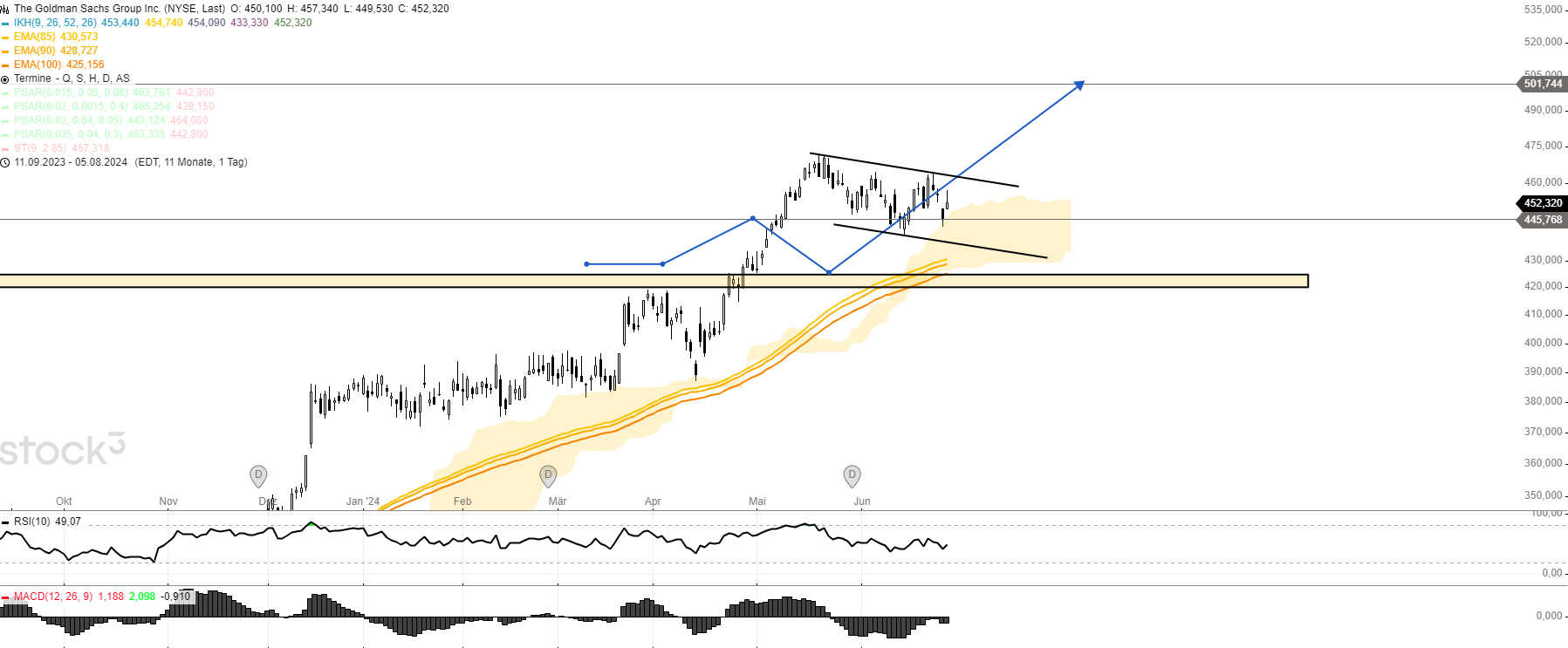

In the short term, the ongoing consolidation is therefore not surprising and invites long opportunities. Goldman Sachs Group still has a target zone on the upside in the area of the round 500 USD mark.

To be precise, the stock has the potential to continue rising to USD 501.75. In my opinion, the current consolidation offers ideal anti-cyclical entry opportunities in the area of the former all-time high. Various supports are concentrated there, such as the support, the IKH cloud and the lower edge of the rainbow indicator. Short-term traders who want to continue to rely on price strength in volatile markets should look at precisely such opportunities.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity