Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

Hermes - Luxury goods about to make a comeback? Countercyclical buying opportunities

Company description

Hermes is a 180-year-old family-owned luxury goods company best known for its Birkin and Kelly bags. Its main businesses are leather goods, which account for about half of its sales, clothing and accessories (21% of sales), silk and textiles (10%) and other products such as perfumes, watches, jewelry and home furnishings.

Fundamental data

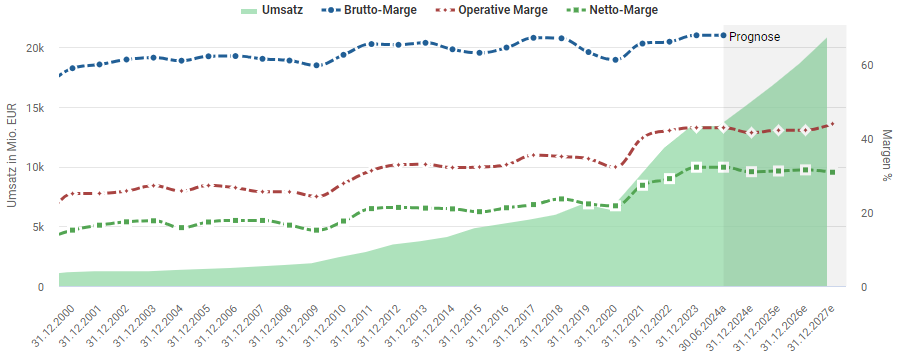

The luxury goods industry is the most profitable in the world. This is of course due to the strong margins that the corporations, and Hermes in particular, deliver. On the other hand, those who can afford these goods are less likely to cut costs than the rest of humanity. Since Corona, Hermes has been able to significantly increase sales and margins and is now around a third higher than its competitors such as Kering or LVMH. This is a strong, fundamental sign.

Chart technical outlook

I also like the stock very much from a technical perspective. After the strong breakout to a new record high at the beginning of February, Hermes' share price is consolidating within a trend channel and recently reached the former breakout and support area of around EUR 2,050. The first bullish advances are likely to start above EUR 2,085. Although it still cannot be ruled out that the luxury goods group's securities will dip to EUR 1,980 before the buying wave could start, it is becoming increasingly unlikely.

Over the next few weeks, Hermes shares could rise significantly in price. They are currently trading in the anti-cyclical buy range, while a pro-cyclical buy signal only arises when the price exceeds EUR 2,250. I see a very likely chance that the share price could reach EUR 2,640. I would like to position myself in this regard. The company will publish quarterly figures on July 25. The estimates for the year indicate a 10% increase in profits.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity