Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

Hilton Worldwide - Beware of major risk with this US stock

Company description

Hilton Worldwide Holdings operates nearly 1.2 million rooms across its more than 20 brands, serving the premium economy to luxury segments. Hampton and Hilton are the two largest brands, accounting for 28% and 19% of the company's total rooms, respectively, as of December 31, 2023. Recent brands launched in recent years include Home2, Curio, Canopy, Spark, Tru, Tempo and LivSmart, as well as a partnership with Small Luxury Hotels and acquisitions of Nomad and Graduate Hotels. Managed and franchised hotels account for the majority of adjusted EBITDA, predominantly in the Americas.

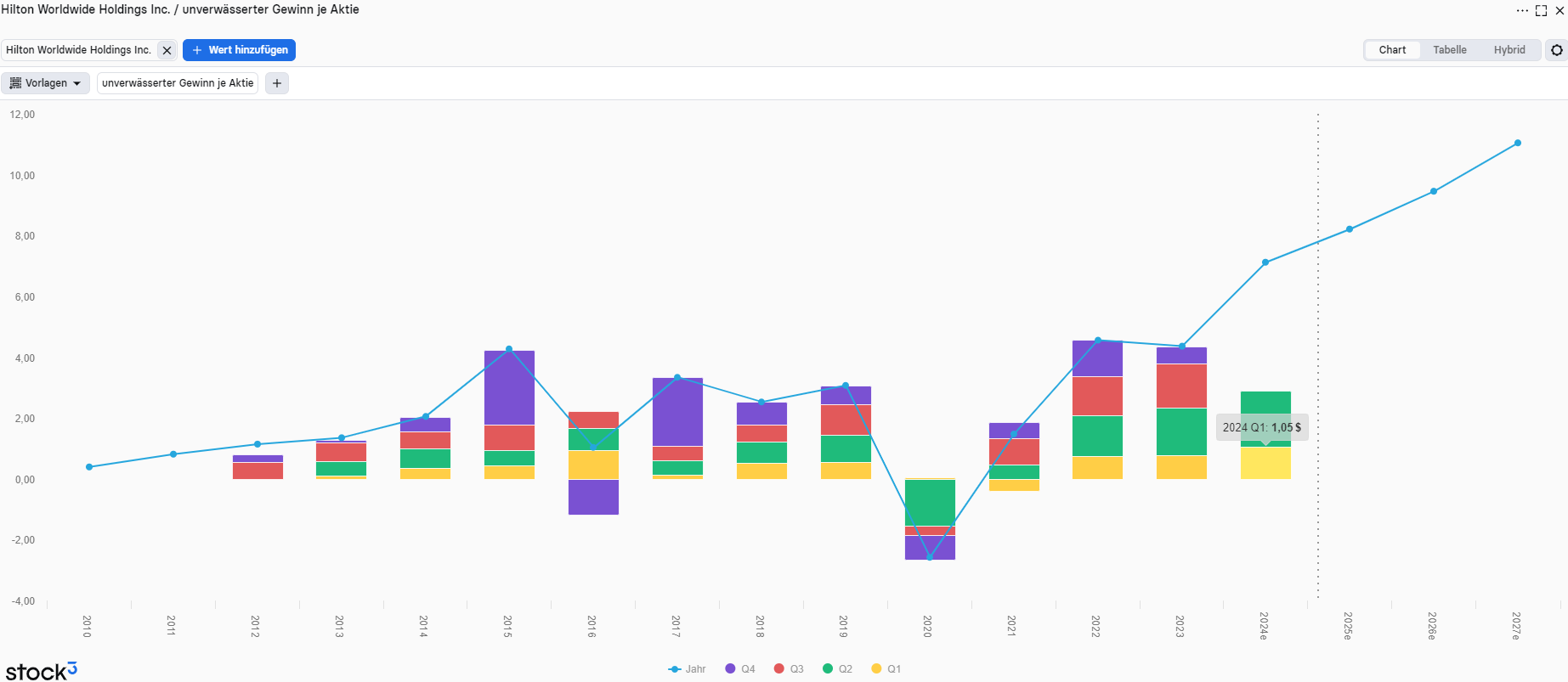

Fundamentals

Well, from a fundamental perspective, analysts are expecting a strong second quarter. EPS of 1.86 per share is forecast. Whether this is actually true and will help the share price remains to be seen. The quarterly figures are expected on August 6, 2024 and are likely to cause price fluctuations in the share price.

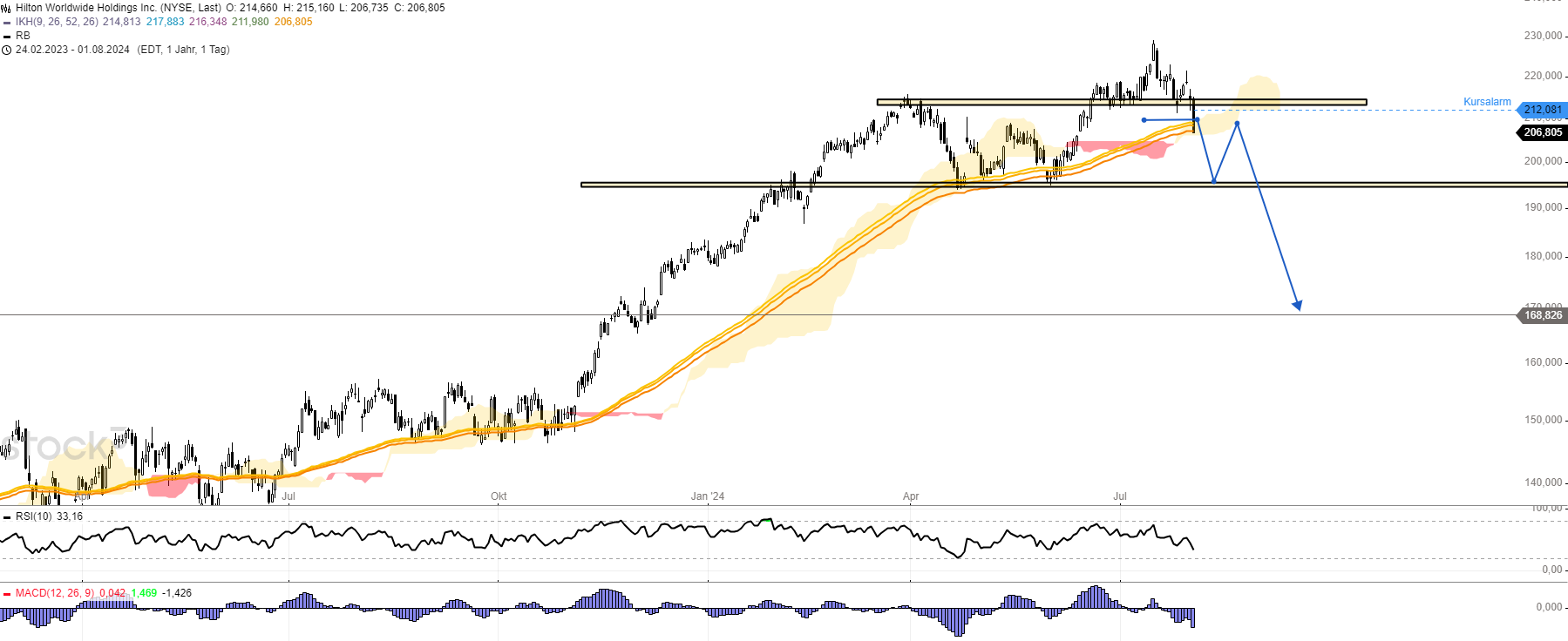

Chart technical outlook

In terms of charts, the situation has already deteriorated. The share price has slipped below the support of 215 USD, opening a downward movement to at least 195 USD. If this price range is also attacked and sustained downwards, 169 USD would be a likely downward mark. I will keep a close eye on the share price and wait to see whether a short position can be implemented.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity