Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

Linde - Long-term trend channel holds --time to buy reached?

Company description

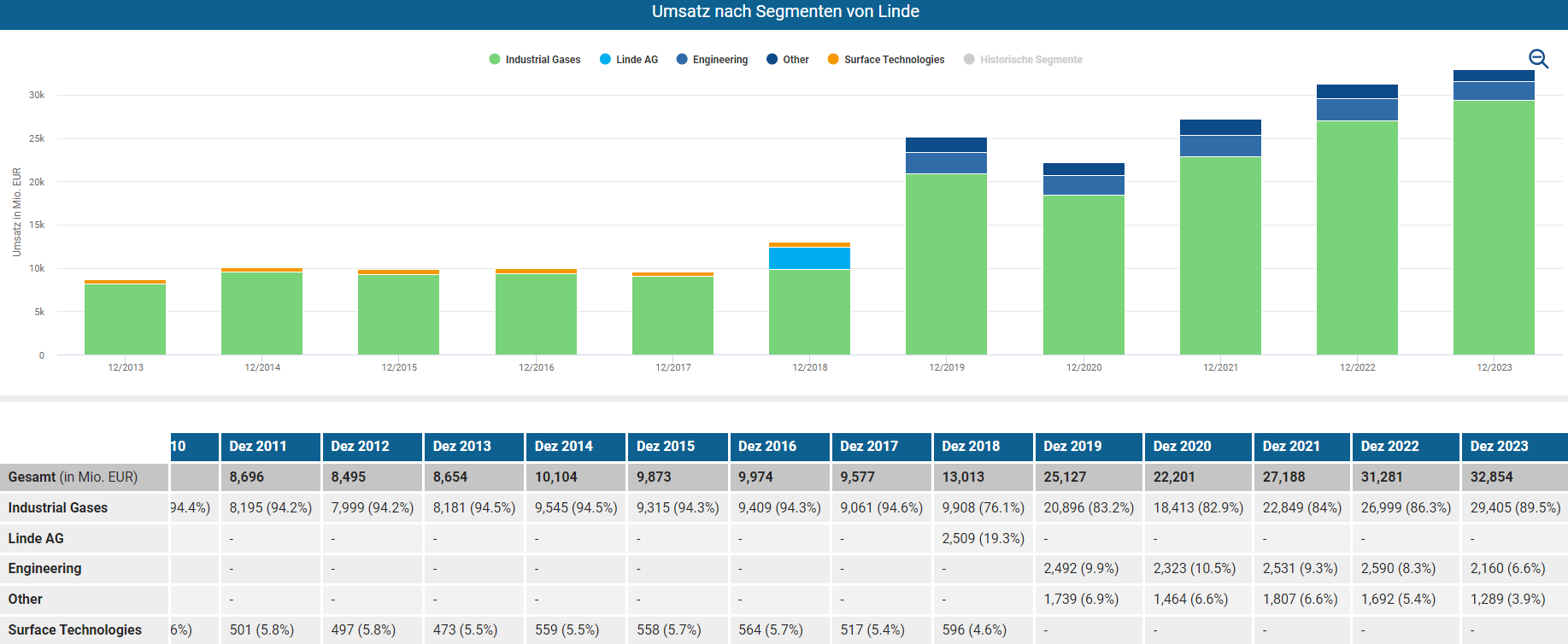

Linde plc is a global company specializing in the provision of industrial gases and engineering services to a wide range of industries. The company was formed in 2018 through the merger of Linde AG and Praxair, Inc. and is headquartered in Guildford, UK. The company has the following business areas:

-

Industrial gases and applications: Linde is one of the world's largest producers and suppliers of industrial gases such as oxygen, nitrogen, argon, carbon dioxide and hydrogen. These gases are used in a wide range of industries and applications, including metalworking, chemicals, food and beverage, electronics, energy and more. Linde also offers technical gases for specialized applications.

-

Plant construction and engineering: In addition to the supply of industrial gases, Linde offers comprehensive engineering and plant construction services. The company designs, builds and operates plants for the production and processing of industrial gases as well as plants for the production of liquefied gas and hydrogen.

-

Healthcare and medicine: Linde is also active in the healthcare sector, offering medical gases, equipment and services to hospitals, clinics, nursing homes and the medical sector. These products support medical applications such as respiratory therapy, anesthesia, emergency medicine and more.

Chart technical outlook

With a strong focus on sustainability and innovation, Linde has positioned itself as a leading provider in the industrial gas industry and strives to meet the needs of its customers worldwide. This demand naturally also has an impact on the company's share price. The stock is currently trading at the lower edge of the long-term uptrend channel. It seems as if buying interest is increasingly emerging again.

There is certainly a possibility that the share price will move upwards again in connection with an improving global economy. On the upside, I have an open price range between 570 and 638 USD, which serves as a long-term target. If the share price slips sustainably below the uptrend line of this trend channel, there is a risk of further losses to at least 400 USD.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity