Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

McCormick - Weak Stock -- Strong Setup

Company description

McCormick & Company operates in the food industry. The company is known for the production of spices, herbs and other flavoring products. In addition, McCormick & Company is active in the production of seasonings and special food ingredients for the catering industry, for households and for food manufacturers. In the area of spices and herbs, McCormick & Company offers a wide range of products that are available both in retail and in bulk for the food industry and catering.

Fundamental outlook

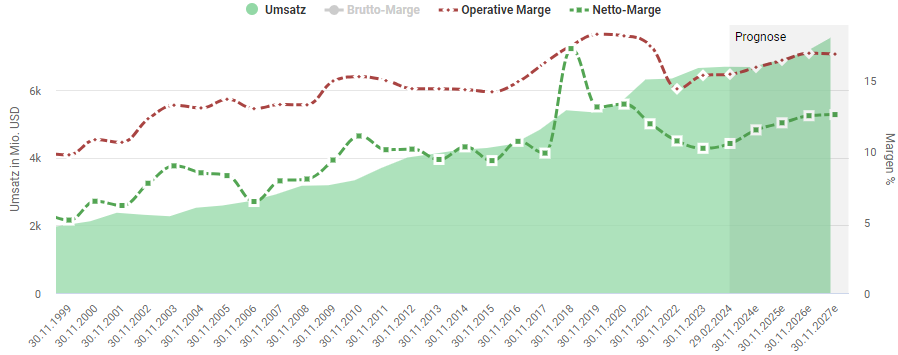

Recently, the industry has suffered somewhat - especially in the area of packaged food, in which the company operates. Since Corona, the fundamental data speaks volumes. Higher operating expenses lead to declining margins. These have fallen by a whopping 20% over the last four years. It goes without saying that the share price cannot reach record highs.

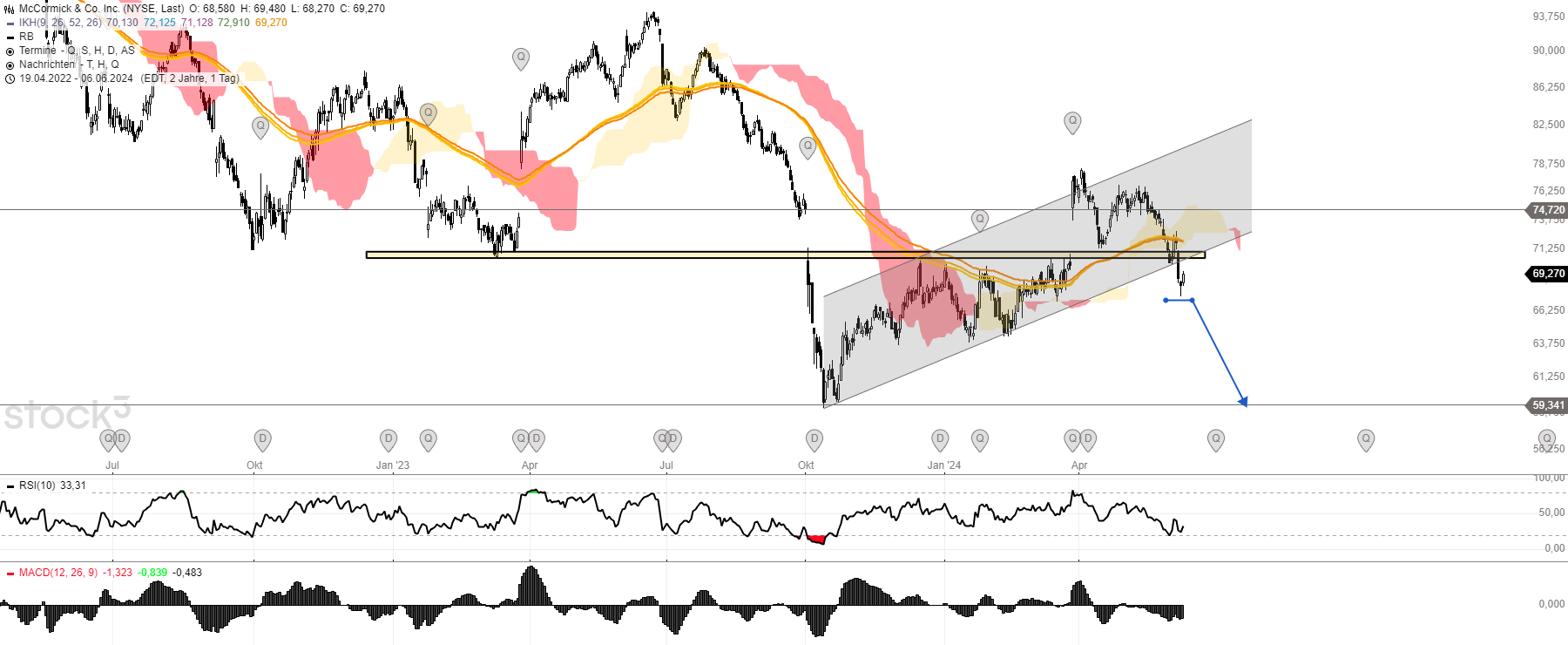

Chart technical outlook

This is also clearly evident when looking at the price trend. The latest movement can be classified as a technical correction within a potential bearish flag, which already indicates a further trend continuation to the downside. I expect further sustained downward movements to around USD 59. The downward momentum should develop with another low. I am watching the stock closely because I am planning to open a short position.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity