Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

McDonalds - I love fast food, but

Company description

McDonald's generates revenue through its own restaurants, franchise royalties and licensing pacts. The restaurants offer low-priced menus with regional variations. As of June 2020, there were around 39,000 locations in more than 120 countries: 36,400 franchisees/affiliates and 2,600 corporate units. After restructuring into segments based on the maturity and competitive position of the different markets, refranchising 4,000 locations and eliminating $500 million in annual distribution costs in recent years, the company is focusing on its "Accelerating the Arches" plan (optimizing the marketing approach, focusing on the core menu, doubling efforts in digital, drive-thru and delivery).

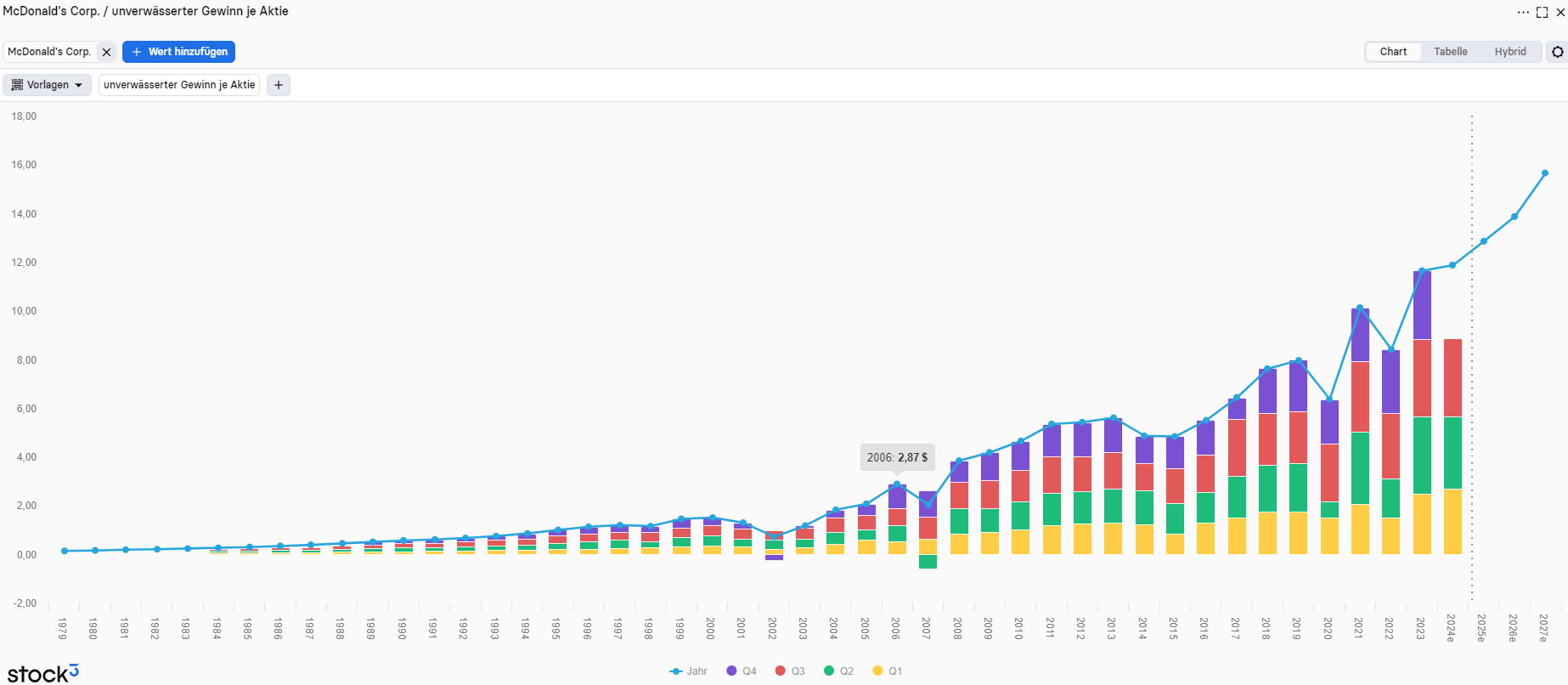

Fundamentals

Recently, McDonalds was able to come up with weak quarterly figures. On July 29, the following figures were published:

McDonald's Corp. missed analysts' estimates of $3.07 with earnings per share of $2.80 in the second quarter. Sales of $6.49 billion were below expectations of $6.62 billion.

Compared to the same quarter last year, this was a decline of over 5%. Nevertheless, analysts are expecting a new record year. Understandable, because on the one hand, McDonalds, as a fast food chain, is a crisis winner in difficult economic times. More people tend to stop going to restaurants, and the fast food chains benefit from this. In addition, the CEO once said: "You don't think I make money from burgers, do you?" He said that he was primarily involved in the real estate business and I agree with him.

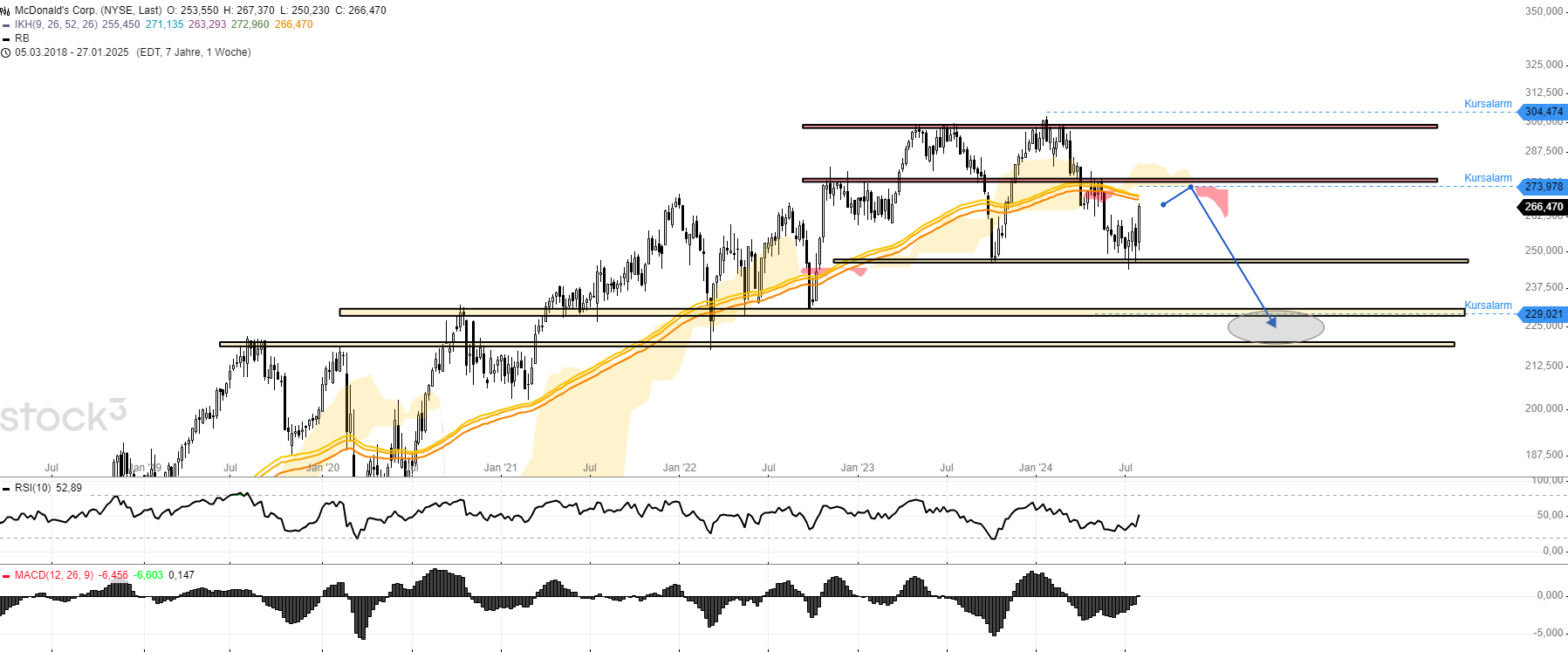

Chart technical outlook

In terms of charts, the McDonalds share is undoubtedly convincing in the long term. The share has never been really cheap and probably won't be. However, I expect another downward wave, which should ideally start at USD 274. In the seasonally weak price environment, which should also cloud the chart situation, I expect a low in the region of around USD 225.

This price level could prove to be extremely lucrative to start stock positions and possibly buy the company in the medium to long term.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity