Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

Rheinmetall - Correction vs. increase in the federal budget -- This is how I position myself now

Company description

Rheinmetall is an international group, listed on the DAX, that operates in various markets and offers technologically leading products and services. The sales focus is on the security technology and mobility segments. Since February 2021, the group structure has consisted of five divisions: Beekle Systems, Weapons and Ammunition, Electronic Solutions, Sensors and Actuators, Materials and Trading. The Vehicle Systems, Weapons and Ammunition and Electronic Solutions division is one of the main suppliers to the defense and security industry for innovative products for German and international armed forces.

latest news

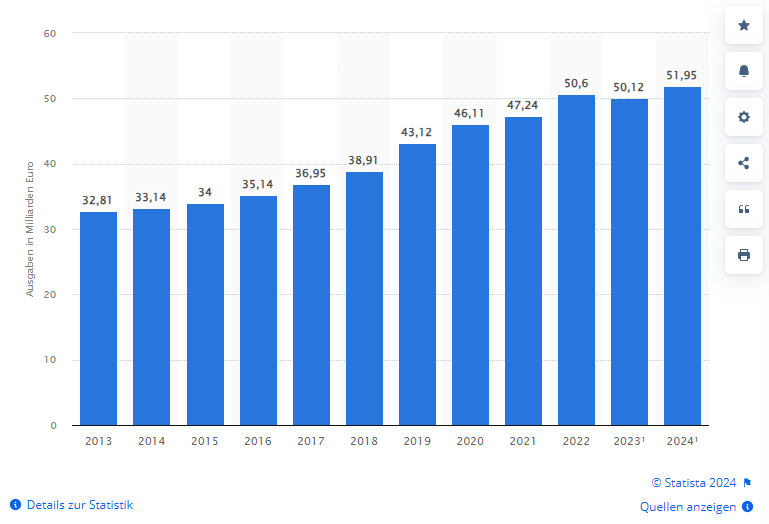

It was recently decided that spending in the federal budget for the Ministry of Defense should increase from the current EUR 52 billion to EUR 80 billion within three years. This means that Germany is meeting NATO's demands to invest at least 2% of GDP. Attached is a diagram of the increasing spending (source: Statista)

That would be almost double the current level. Rheinmetall is of course one of the leading companies in Europe. The group has already benefited massively from the current geopolitical events, which have been going on for several years. Many orders from many countries. Some of this could be included in the share price.

Chart technical outlook

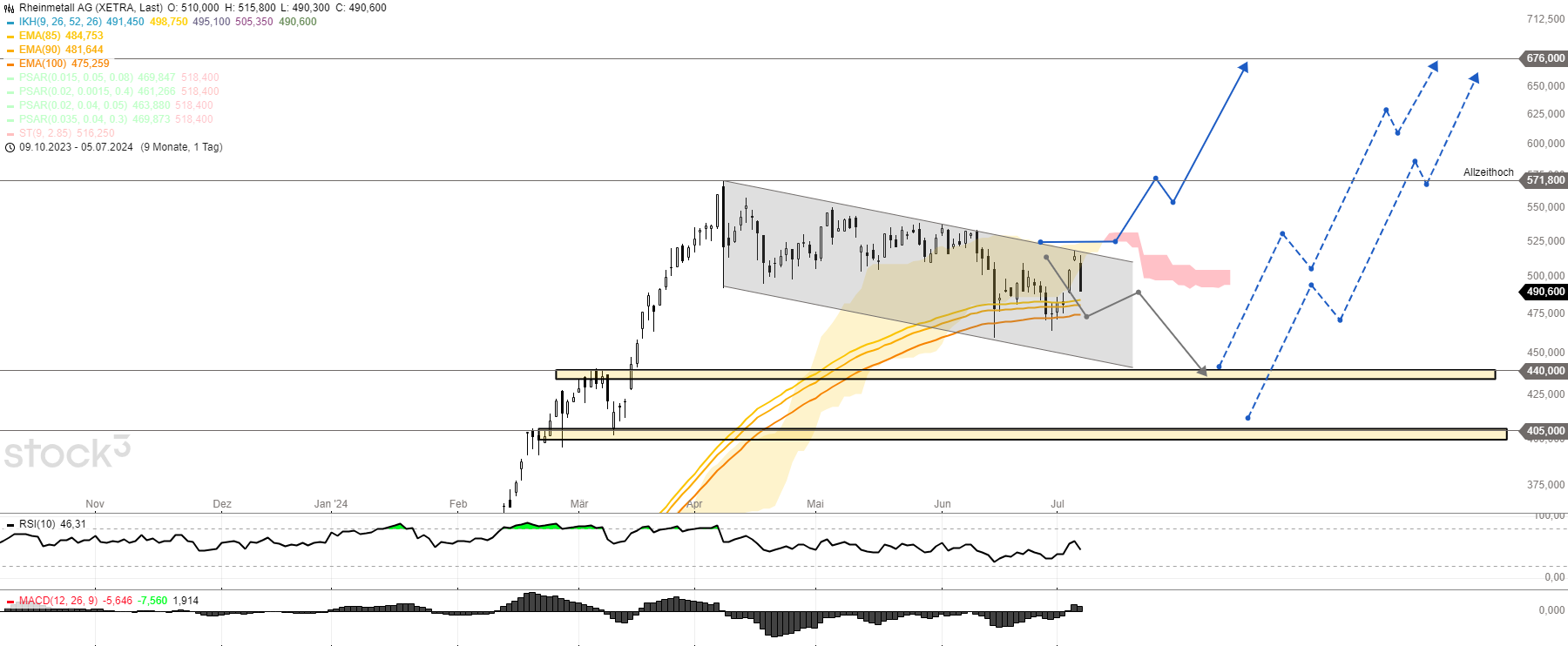

Nevertheless, there are still trading opportunities here that I would like to take advantage of. At the moment, I really like Rheinmetall shares. And that's despite the fact that they are still in the middle of a correction after reaching an important medium-term target of around EUR 550. The correction can currently be seen within a bullish flag, a classic trend continuation formation that is likely to be resolved in the overarching trend direction.

After the share price failed to break through the trend channel limit last week, there are increasing signs that the recent upward movement must only be seen as an interim correction. This should result in new lows. I currently see an ideal price zone for an anti-cyclical entry in the area of just under EUR 442. If market participants are unable to use this, EUR 405 will most likely ensure this upward movement.

Procyclical signals only emerge above EUR 519 with the breakout from the trend continuation formation. I currently consider it more likely that the share price of Rheinmetall securities will reach a new record high in the region of EUR 676.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity