Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

Sartorius - New 52-week low triggers next sell signal -- 20% downside potential!

Company description

Sartorius AG is a leading provider of bioprocess solutions. The company's Bioprocess segment sells equipment and consumables for upstream and downstream manufacturing of biopharmaceuticals, with a focus on single-use technologies or SUTs. Laboratory Product Services offers a wide range of laboratory products, including balances, pipettes and filter devices.

latest news

The change of management announced today is sending the DAX share price further down. It has been reported that CEO Joachim Kreuzburg is not seeking a long term in office and that a change of management is therefore due to take place in autumn 2025:

Sartorius shares reacted to the departure of the company's CEO with price fluctuations. A new low since March 2020 was followed by a turnaround into positive territory and now another low of around 200 euros.

Long-standing CEO Joachim Kreuzburg wants to finish his contract, which runs until November 2025, but not extend it. In their initial reaction to the conference call, stock market analysts stressed that the departure had nothing to do with the course of business. However, it is expected that Sartorius will publish key figures before the half-year results due in mid-July. Source: dpa-AFX

Fundamentals

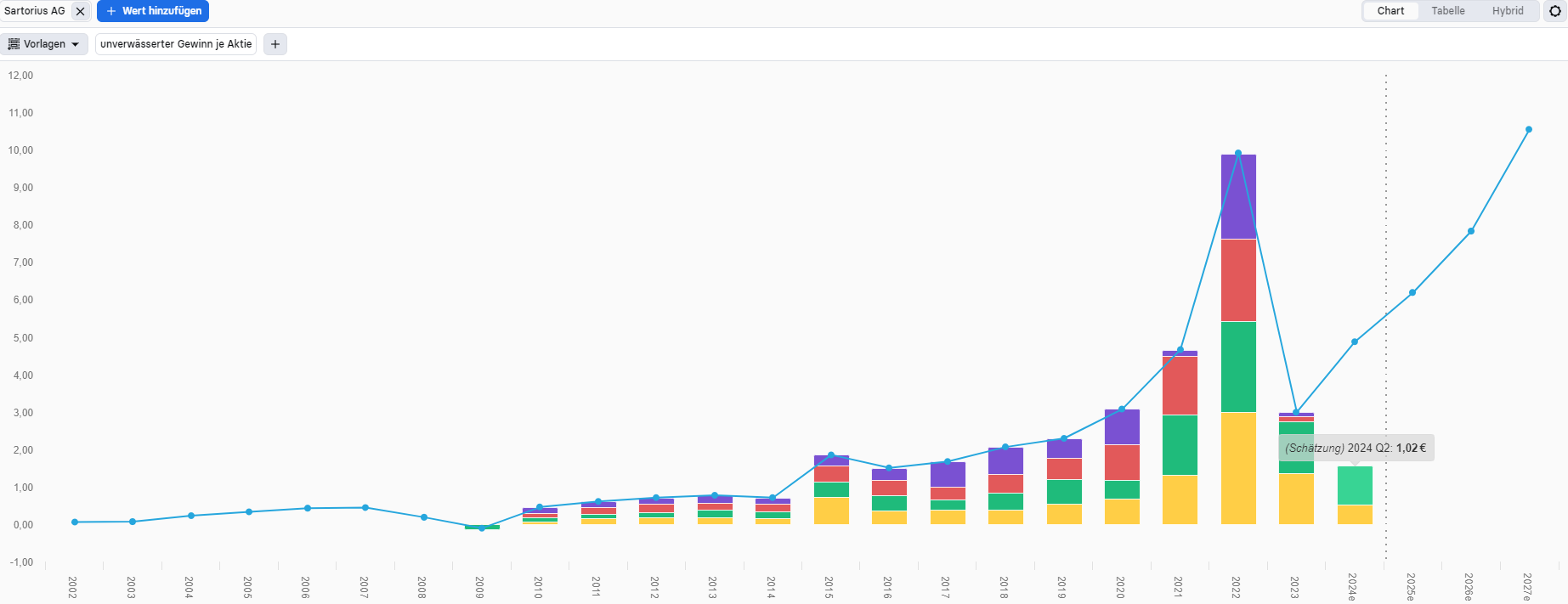

The company's figures will be presented on July 19th of this year. Analysts are also expecting a significant decline compared to the same period last year. To be more precise, a profit of EUR 1.02 is expected. This is a drastic reduction compared to EUR 1.39 in the same period last year.

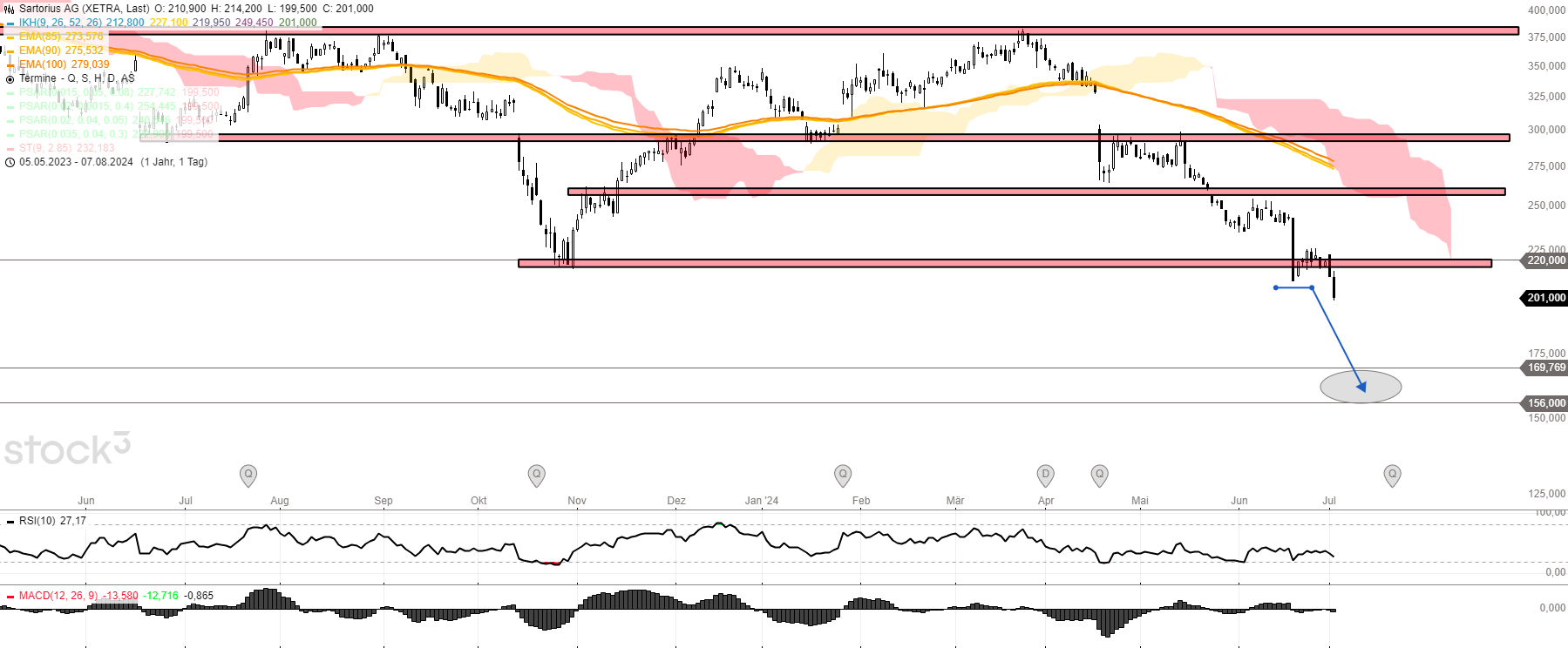

Chart technical outlook

The technical chart situation is now clear. There is even the possibility of placing a short order to profit from further falling prices to around EUR 160. After Sartorius shares recently failed to break the resistance level of EUR 220, the current news situation is leading to sellers continuing to stock up. I could imagine a consolidation lasting a few hours, but I am still expecting weakness in the next few days, which could result in a further price drop of 20%. I plan to position myself accordingly.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity