Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

Uber - When will the next passenger board?

Company description

Uber Technologies is a technology provider that connects riders with drivers, hungry people with restaurants and food delivery services, and shippers with carriers. The company's on-demand technology platform could eventually be used for additional products and services, such as autonomous vehicles, drone delivery, and Uber Elevate, which the company calls "airborne ridesharing." Headquartered in San Francisco, Uber Technologies operates in over 63 countries with over 91 million users who order rides or food at least once a month. About 83% of gross revenue comes from ridesharing and 16% from food delivery.

Fundamentals

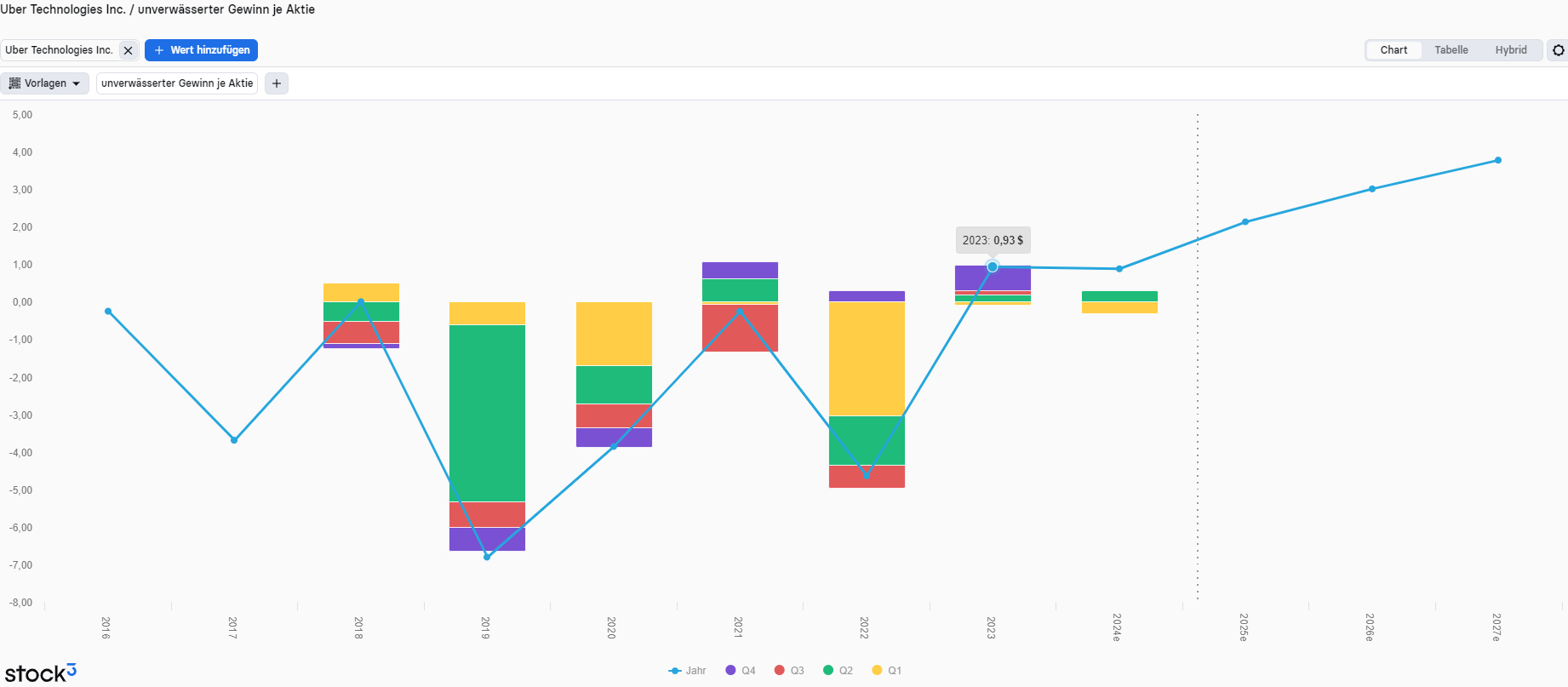

Fundamentally, things also seem to be improving at the same time. Earnings per share (EPS) have been increasing on average since . The company even ended last year with a profit. The company's quarterly figures are expected again on August 6th. Analysts are expecting a profit of USD 0.31 per share for the second quarter. If the estimates are confirmed and a chart-technical reversal is evident, it is definitely worth a look.

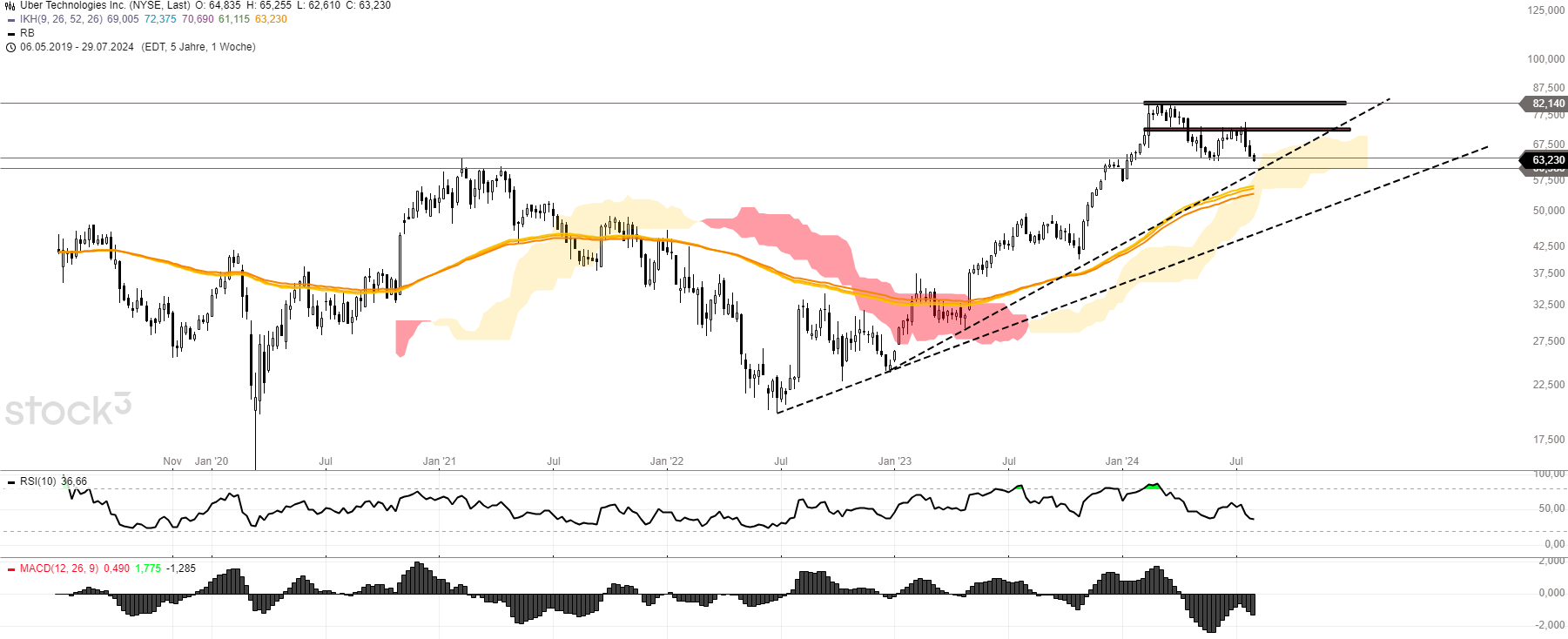

Chart technical outlook

In terms of charts, the share is still in a long-term, intact uptrend. Since the all-time high of USD 82.14, the share has now entered a correction. It is currently trading at the former breakout area of around USD 63. From an analytical point of view, this retracement is flawless and, as is textbook practice, in 70% of all cases after a breakout, this retracement is maintained. In the medium term, the share could therefore be quite interesting if it can prevail against the current volatile market phase. A renewed attempt to reach the record high is quite conceivable.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity