Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

US data - Now things are getting exciting -- FED under pressure?

Economic data

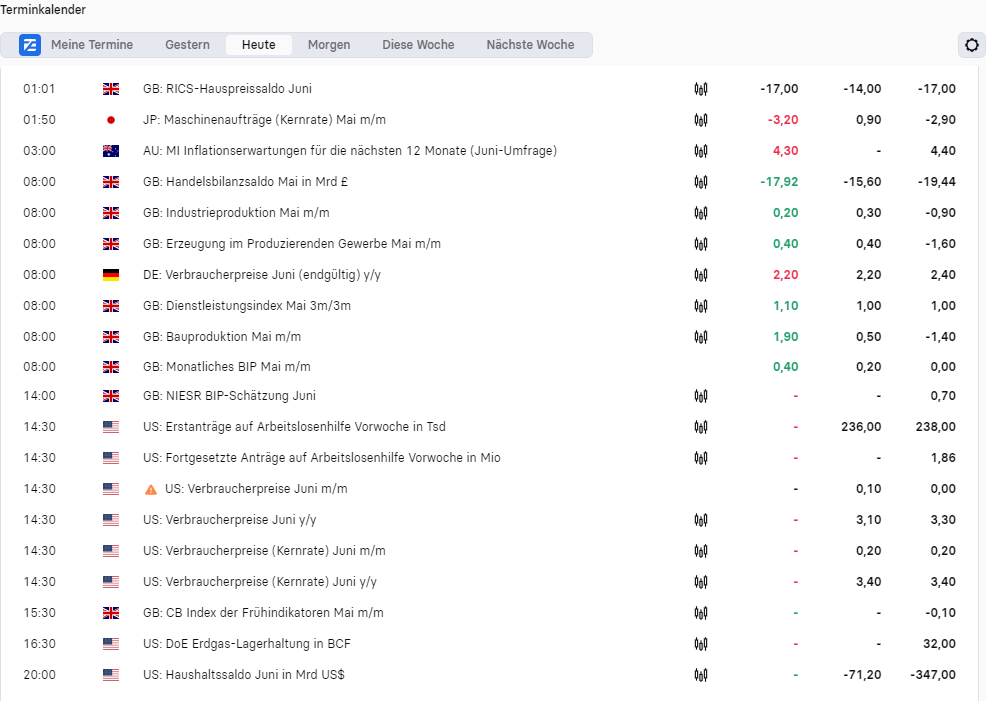

We can expect important economic data from the USA this afternoon and tomorrow. This data is of course of enormous importance for the FED with regard to interest rate policy and is likely to cause high volatility on the stock markets.

On the one hand, consumer prices await us at 1430

CPI

What are consumer prices?

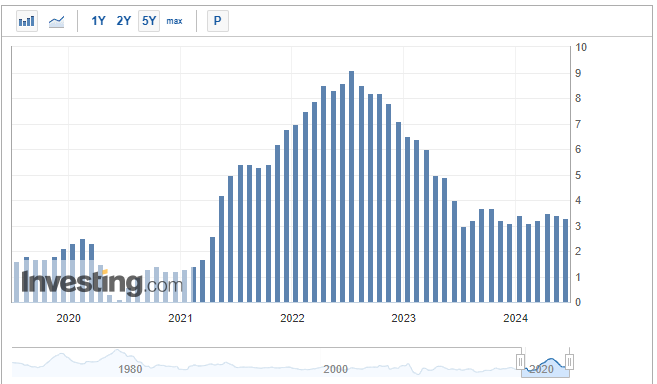

The consumer price index (CPI) is calculated using a basket of goods and services that an average household in the USA buys. This produces the consumer price index, which is considered a key indicator for consumer behavior and inflation. Since last year, the value has fluctuated around 3.3%, signaling that the increased interest rates are having an effect and that inflation is not increasing any further.

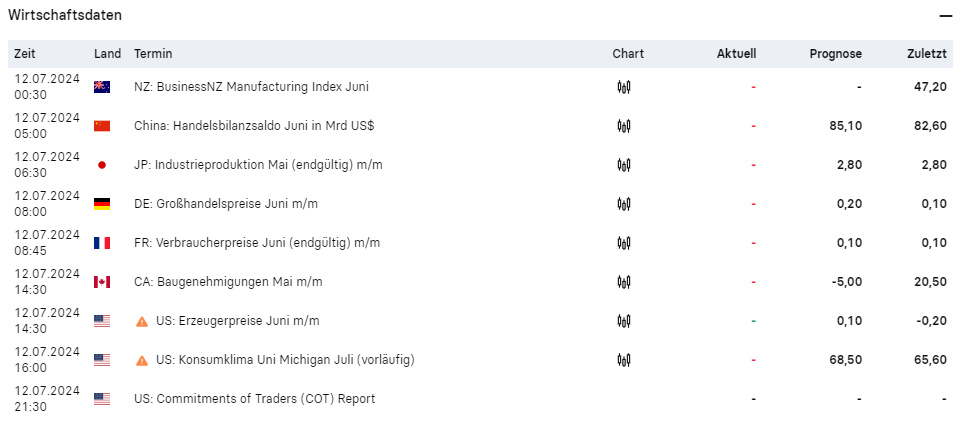

Tomorrow, in addition to the consumer climate in Michigan, we will also see producer prices, which will also be reported at 2:30 p.m.

EPI

What are the producer prices?

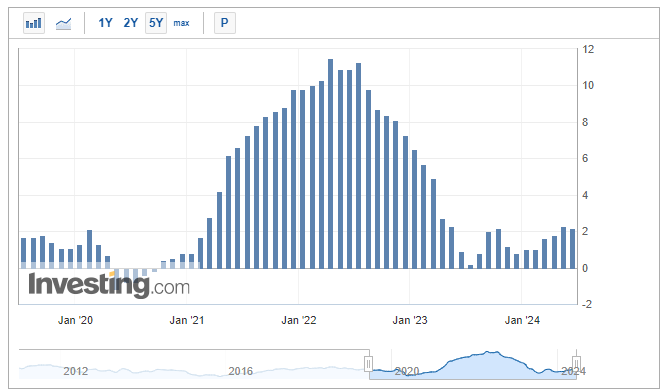

The Producer Price Index (PPI) measures the products and services produced in the United States and sold domestically in terms of changes in transaction prices. The PPI is an output index - it measures price changes from the seller's perspective and is therefore also used to forecast inflation.

It is clear that these have been increasing significantly since last year.

While economists' estimates do not expect any changes in the EPI, a decline is expected in the CPI. If both indices fall, this is another indicator that an interest rate cut in the USA is imminent and may provide relief on the stock markets. But it is also a fact that these data are just two of many that the FED must take into account.

In addition to the blog that is actively maintained here, my information portal Investment.Traders contains other exciting articles, detailed stock analyses, presentations of various investment opportunities and a weekly update in video form. This is my contribution to financial education in Germany.

Leave a comment

Related posts

Munich Re - One record chases the next

Munich Re - One record chases the next

Eli Lilly - Range breakout sets new all-time highs

Eli Lilly - Range breakout sets new all-time highs

Puma - Ideal correction invites you to buy

Puma - Ideal correction invites you to buy

AMD shares: AI chips boost the company -- Current buying opportunity

AMD shares: AI chips boost the company -- Current buying opportunity