Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

Search in blog

Blog categories

- FAQ – Your guide through the world of finance and technical facilities (2) click

- Daytrading Almanac (27) click

- Press release (23)

- Educational (26) click

- Projects (9)

- Chart analysis (39) click

- Trading bots for cTrader (11)

- AI in trading (5)

- Trading Strategien (11)

- Trading signals and stock market letters (46)

Latest posts

When it comes to traders, social media platforms often create a rather one-sided image: a young face smiling at the...

The TegasFX Instant Funding program sets a new standard for traders seeking quick access to capital without having to...

Backtesting trading strategies is an essential tool for traders who want to validate their methods across historical...

introduction In the world of trading, it can be challenging to balance the intense market activity and the rapid...

Popular posts

Featured posts

Photo gallery

No featured images

Archived posts

Top authors

-

Christian Lill 70 Posts View posts

Christian Lill 70 Posts View posts -

-

-

-

Fundamental analysis

Fundamental analysis

Introduction

Fundamental analysis is a method of determining the intrinsic value of a stock or other financial instrument by examining economic, financial and other qualitative and quantitative factors. This analysis takes into account influences such as the state of the economy, industry and company management to assess whether a stock is undervalued or overvalued. The goal is to make long-term investment decisions by understanding the true drivers of a company's value and how these might evolve over time.

Risk Sentiment

refers to the general mood or attitude of investors towards the prevailing risks in the financial markets. It reflects whether market participants are willing to take on higher risks (risk appetite) or whether they are seeking safety (risk aversion). This sentiment indicator is often influenced by political events, economic reports or market volatility and can significantly affect market performance and investors' decisions by leading to either greater demand for riskier assets or a retreat to safer forms of investment.

Business news

play a crucial role in the fundamental analysis of financial markets. They include data on economic growth, the labor market, inflation, central bank policy and other macroeconomic indicators that can affect financial markets. Investors and traders use this news to make assessments about the economic situation and possible interest rate decisions, which in turn directly influences their investment decisions and market sentiment. Effective use of this information can be crucial to identifying market opportunities and managing risks.

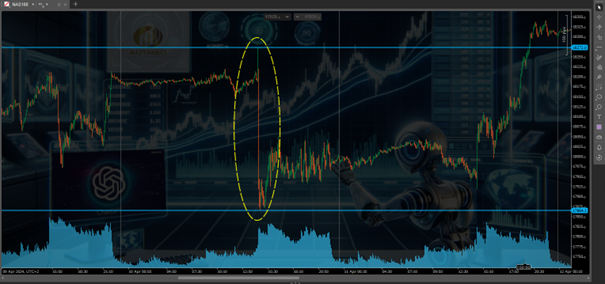

Example of how the market can react to economic news:

Central banks

Central banks are key institutions in a country's economy that are primarily responsible for monetary policy. Their tasks include regulating the money supply and interest rates to control economic stability and inflation. They play a key role in financial markets, particularly through their decisions regarding key interest rates, which have a direct impact on currency values. Central banks such as the US Federal Reserve, the European Central Bank or the Bank of Japan are therefore key players for fundamental analysts.

The markets react very volatilely, especially when the FED or the ECB make interest rate decisions. It is advisable not to trade during these days.

Inflation and the labor market

Inflation and the labor market are two key economic indicators that are closely linked and play a central role in fundamental analysis.

Inflation: Measures the rate at which the general price level for goods and services is rising, thereby reducing the purchasing power of the currency. Central banks often respond to high inflation rates by raising interest rates.

Labor market: Refers to data on employment and unemployment. A strong labor market with high employment can indicate a healthy economy, but it also often leads to inflationary pressures as higher wages can increase product costs.

Both factors influence the monetary policy decisions of central banks, which in turn can have a significant impact on the financial markets. Before each trading session, every trader should familiarize themselves with the dates that could have a major impact on the market. This data is provided by various financial news sites. For example, Finanzen.net or Capital.com.

Big Picture

Big picture in economic analysis refers to the comprehensive overview of global economic and political conditions that affect financial markets. This analysis encompasses a variety of factors, including geopolitical events, global economic trends, currency stability, and key economic indicators such as growth rates, trade balances, and central bank policies. Investors and analysts use the big picture to develop long-term investment strategies and understand how various economic, social, and political forces interact to shape market conditions.

Leave a comment

Related posts

Can you make a living from trading?

Can you make a living from trading?

Basics

Basics

Trading variants

Trading variants

Technical Analysis

Technical Analysis