Between reality and illusion If you want to know what trading really means—beyond luxury cars, piles of cash, and...

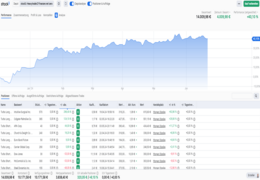

Announcement of a change of CEO and weak fundamental data send the share price into a downward spiral - a short setup is opening up here